Chargeback Management Services - Dispute Response Sep/ 4/ 2025 | 0

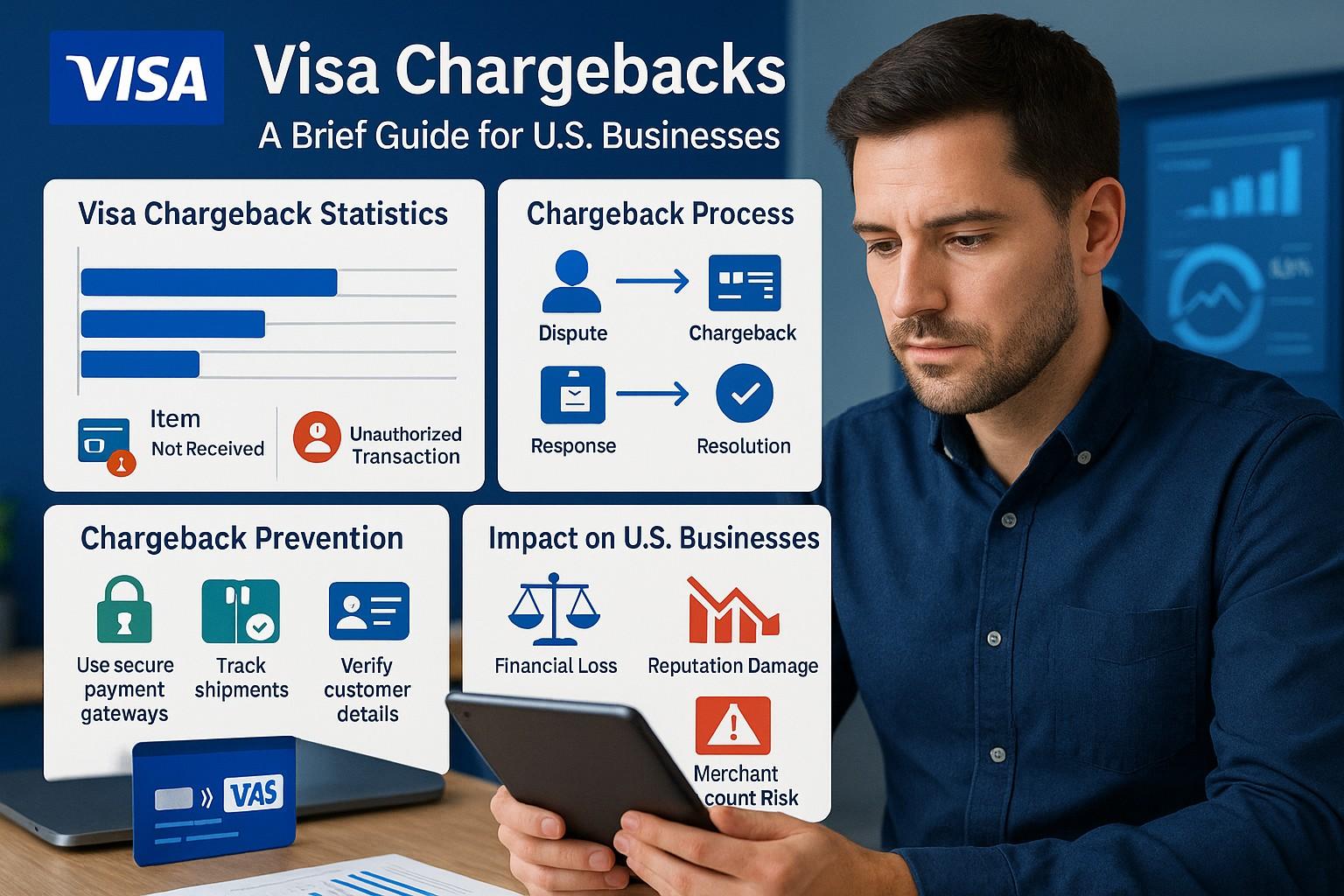

Visa chargebacks are a significant issue for businesses worldwide, especially in the U.S., where the rise of online transactions has led to an increase in disputed payments. Understanding how Visa chargebacks work, why they occur, and how to effectively manage them is crucial for any business in 2025. In this guide, we’ll break down essential steps to handle chargebacks, the key causes behind them, and best practices to mitigate their impact.

What Is a Visa Chargeback?

A chargeback occurs when a cardholder disputes a transaction and requests their bank to reverse the payment. Visa chargebacks are typically initiated due to fraud, dissatisfaction with a purchase, or processing errors. They serve as a consumer protection tool but can be a significant challenge for merchants, especially when dealing with high volumes of transactions.

Common Causes of Visa Chargebacks

Understanding the root causes of chargebacks helps businesses prevent and respond more effectively. Here are some of the most common reasons behind Visa chargebacks in 2025:

- Fraudulent Transactions

Fraud is a leading cause of chargebacks. Criminals often use stolen card details to make unauthorized purchases, leading to chargebacks when the cardholder realizes the fraud. - Customer Disputes

If a customer is dissatisfied with a product or service, they may initiate a chargeback. Reasons for disputes include poor product quality, non-delivery of goods, or issues with the return process. - Processing Errors

Mistakes during transaction processing, such as double charges, incorrect billing, or delays, can result in chargebacks. - Merchant Non-Compliance

Failure to comply with Visa’s chargeback management policies can result in chargebacks, as well as additional fees for non-compliance.

How to Prevent Visa Chargebacks

Preventing chargebacks is critical to maintaining a healthy bottom line and protecting your business from financial losses. Here are some strategies to minimize Visa chargebacks:

- Implement Strong Fraud Detection Measures

Use advanced fraud detection tools like 3D Secure and address verification systems (AVS) to minimize fraudulent transactions. Monitor unusual buying patterns and set up alerts to detect suspicious activity. - Provide Clear Return Policies

A transparent and fair return policy can reduce the likelihood of customer disputes. Ensure that your return and refund policies are easy to understand and prominently displayed on your website. - Maintain Detailed Transaction Records

Keep thorough records of all transactions, including receipts, customer communications, and shipping confirmations. This can help provide evidence in the event of a dispute. - Use a Reputable Payment Gateway

Partner with a trusted payment processor that offers strong chargeback management features. A reliable payment gateway can help identify and resolve chargeback issues faster. - Stay Compliant with Visa Regulations

Make sure your business follows Visa’s chargeback rules and regulations to avoid additional penalties. Regularly review Visa’s guidelines to ensure your processes are up to date.

What to Do When You Receive a Visa Chargeback?

Receiving a chargeback can be frustrating, but knowing how to respond can make a significant difference in the outcome. Here’s a step-by-step guide to handling Visa chargebacks effectively:

- Review the Chargeback Reason Code

Visa provides a reason code when a chargeback is initiated. Understanding the specific reason can help you address the issue more effectively. - Gather Evidence

Collect all relevant documentation, such as transaction receipts, emails, shipping records, and any communication with the customer. This will be crucial when presenting your case to Visa. - Submit Your Response Within the Deadline

Visa imposes strict deadlines for submitting chargeback responses. Make sure to respond promptly to avoid automatic chargeback loss. - Consider Representment

If you believe the chargeback is invalid, you can initiate a representment process to contest the decision. This involves presenting evidence to Visa to prove the chargeback is unwarranted.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion: Managing Visa Chargebacks in 2025

Visa chargebacks are an ongoing challenge for businesses, but with the right tools, strategies, and knowledge, you can effectively manage and prevent them. By investing in fraud prevention, maintaining clear policies, and responding promptly to disputes, you can safeguard your business from chargeback-related losses in 2025.