Chargeback Management Services - Dispute Response Jul/ 31/ 2025 | 0

In 2025, understanding Visa’s chargeback fee structure is essential for U.S. businesses looking to minimize financial losses. Chargebacks are a common part of the payment process, but with the right knowledge, businesses can better manage these costs and avoid penalties.

What Is a Visa Chargeback Fee?

A Visa chargeback fee is a penalty that businesses incur when a customer disputes a charge made on their credit card. This fee is levied by the payment processor and covers the administrative costs associated with handling the dispute.

- Chargeback Process:

- The customer files a dispute, and the merchant has the opportunity to respond.

- If the dispute is upheld, the merchant is liable for the chargeback fee and the transaction amount.

- The customer files a dispute, and the merchant has the opportunity to respond.

- Why It Matters for Your Business:

- Financial Impact: Chargeback fees can accumulate quickly, especially for businesses with high transaction volumes.

- Reputation Risks: A high chargeback ratio can signal poor customer service or potential fraud, damaging the merchant’s reputation with payment processors.

- Financial Impact: Chargeback fees can accumulate quickly, especially for businesses with high transaction volumes.

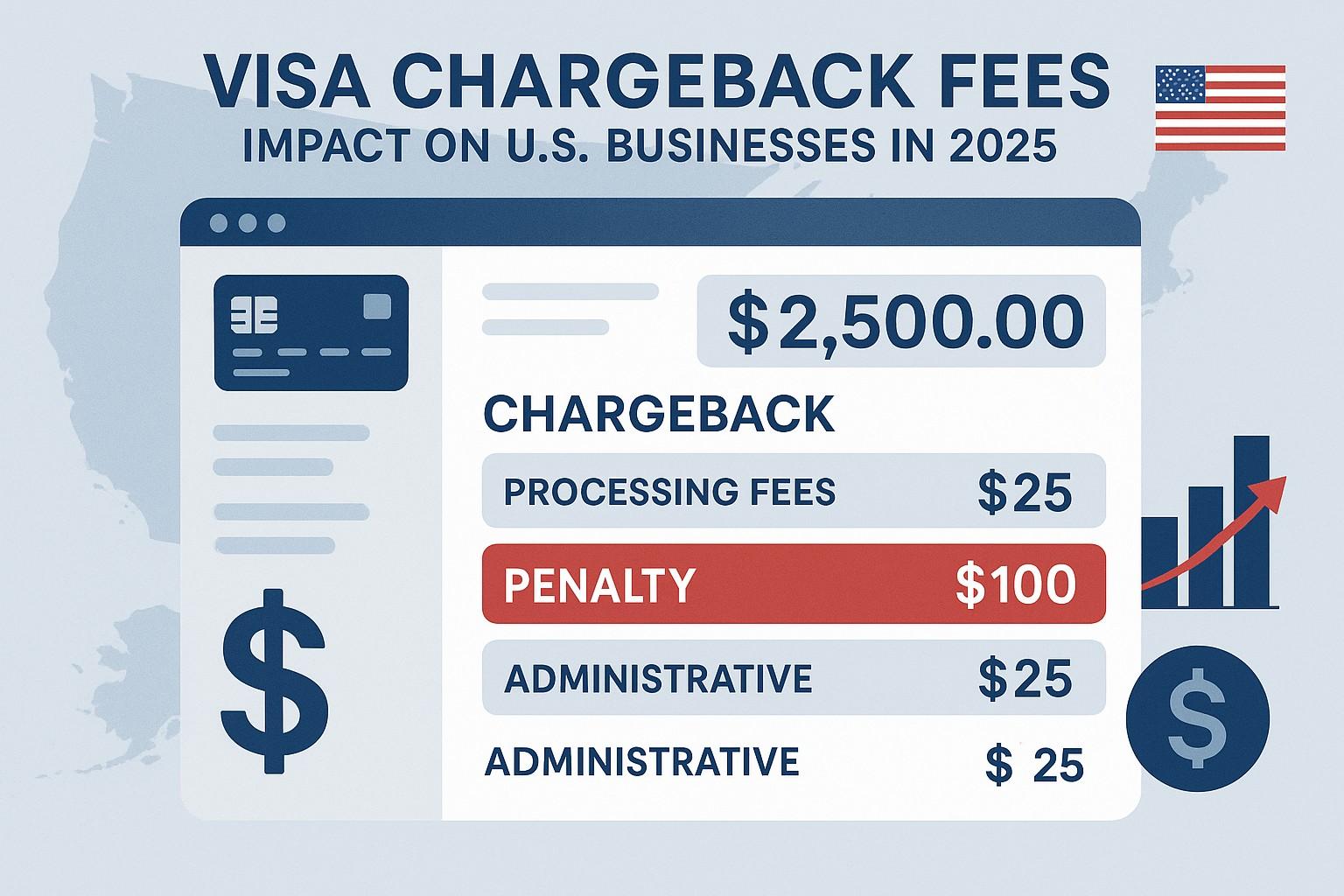

How Much is the Visa Chargeback Fee in 2025?

Visa chargeback fees typically range from $20 to $100 per chargeback, depending on the merchant’s agreement with the payment processor and the type of dispute. However, fees can escalate for high-risk merchants or those with a consistent history of chargebacks.

Factors Affecting Chargeback Fees

- Type of Dispute: Different types of chargebacks, such as fraud or customer disputes, may incur different fees.

- Merchant Category: High-risk industries may face higher fees or additional penalties.

What Are the Additional Costs?

In addition to the chargeback fee, businesses may face other penalties, such as:

- Loss of Revenue: The refunded amount to the customer.

- Operational Costs: Resources spent handling the chargeback process.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Strategies to Minimize Visa Chargeback Fees

1. Implement Strong Fraud Prevention Measures

Use tools like Address Verification System (AVS) and 3D Secure to prevent unauthorized transactions.

2. Provide Clear and Transparent Billing Information

Ensure that your descriptors are accurate and match your business name to reduce disputes.

3. Respond to Chargeback Notifications Promptly

Always address chargeback notifications quickly, providing clear evidence to avoid losing the dispute.

4. Offer Excellent Customer Support

Proactively resolve customer issues before they escalate to chargebacks by offering responsive customer service.