Chargeback Management Services - Dispute Response Aug/ 6/ 2025 | 0

Chargebacks aren’t just a refund—they’re a warning sign. If you’re a U.S. business in 2025, understanding the true cost of a single chargeback is critical to protecting your bottom line. From lost revenue and penalties to increased risk ratings and merchant account terminations, the impact runs deep.

In this guide, we’ll break down the actual cost of a single chargeback and provide tips to minimize these losses.

What is a Chargeback?

A chargeback is a reversal of a credit card transaction initiated by the cardholder’s issuing bank. It’s designed to protect consumers from fraud or poor service. However, when misused or left unmanaged, chargebacks can cripple merchants—especially those in eCommerce and high-risk industries.

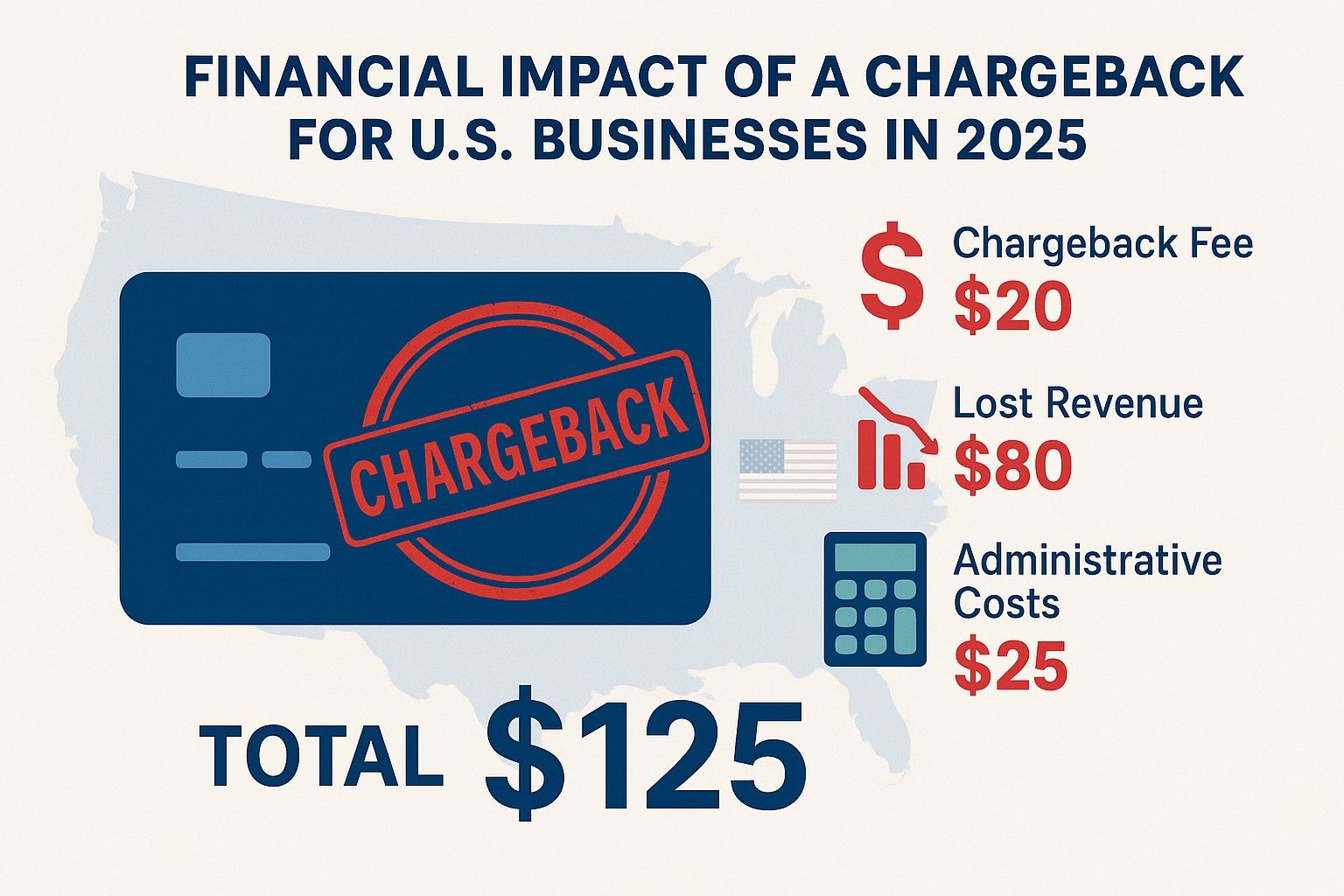

Many businesses think a chargeback only costs them the disputed transaction amount. Unfortunately, that’s just the beginning.

Here’s a breakdown of the true cost in 2025:

| Component | Average Cost (2025) |

| Lost Revenue | $100 (based on average sale) |

| Product or Service Loss | $100 |

| Shipping/Operational Cost | $10–$25 |

| Chargeback Fee (per case) | $20–$100 |

| Increased Processing Fees | Varies |

| Risk of Merchant Account Closure | High if ratio exceeds 1% |

➡️ Estimated total cost per chargeback: $150–$300+

Hidden Costs to Consider

Beyond the direct financial loss, chargebacks can lead to:

- Increased reserve requirements

- Terminated merchant accounts

- Damage to brand reputation

- Lost future business from the same customer

Merchants labeled as “high-risk” may face even stricter scrutiny from payment processors.

Chargeback Ratio: Why It Matters

Your chargeback ratio—calculated as chargebacks divided by total transactions—should always remain under 1%. Exceeding this threshold can flag your business for monitoring, result in higher fees, or even termination by your payment provider.

How to Reduce Chargeback Costs

Here’s how U.S. businesses can prevent chargebacks and reduce their financial impact in 2025:

1. Use Clear Billing Descriptors

Avoid customer confusion by using business names that customers recognize on bank statements.

2. Implement Real-Time Alerts

Use tools that notify you of chargebacks as they happen, so you can respond swiftly.

3. Provide Excellent Customer Support

Offer accessible and timely customer service to resolve complaints before they escalate.

4. Maintain Detailed Records

Always have proof of delivery, transaction details, and customer communications ready.

5. Partner with a Chargeback Management Firm

Work with experts like Dispute Response to manage, respond, and prevent future chargebacks effectively.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Partner with Dispute Response

At Dispute Response, we help U.S. merchants not only fight chargebacks—but prevent them before they happen. With our advanced dispute resolution tools and real-time analytics, you can minimize losses, protect your reputation, and keep your business growing.