Chargeback Management Services - Dispute Response Sep/ 2/ 2025 | 0

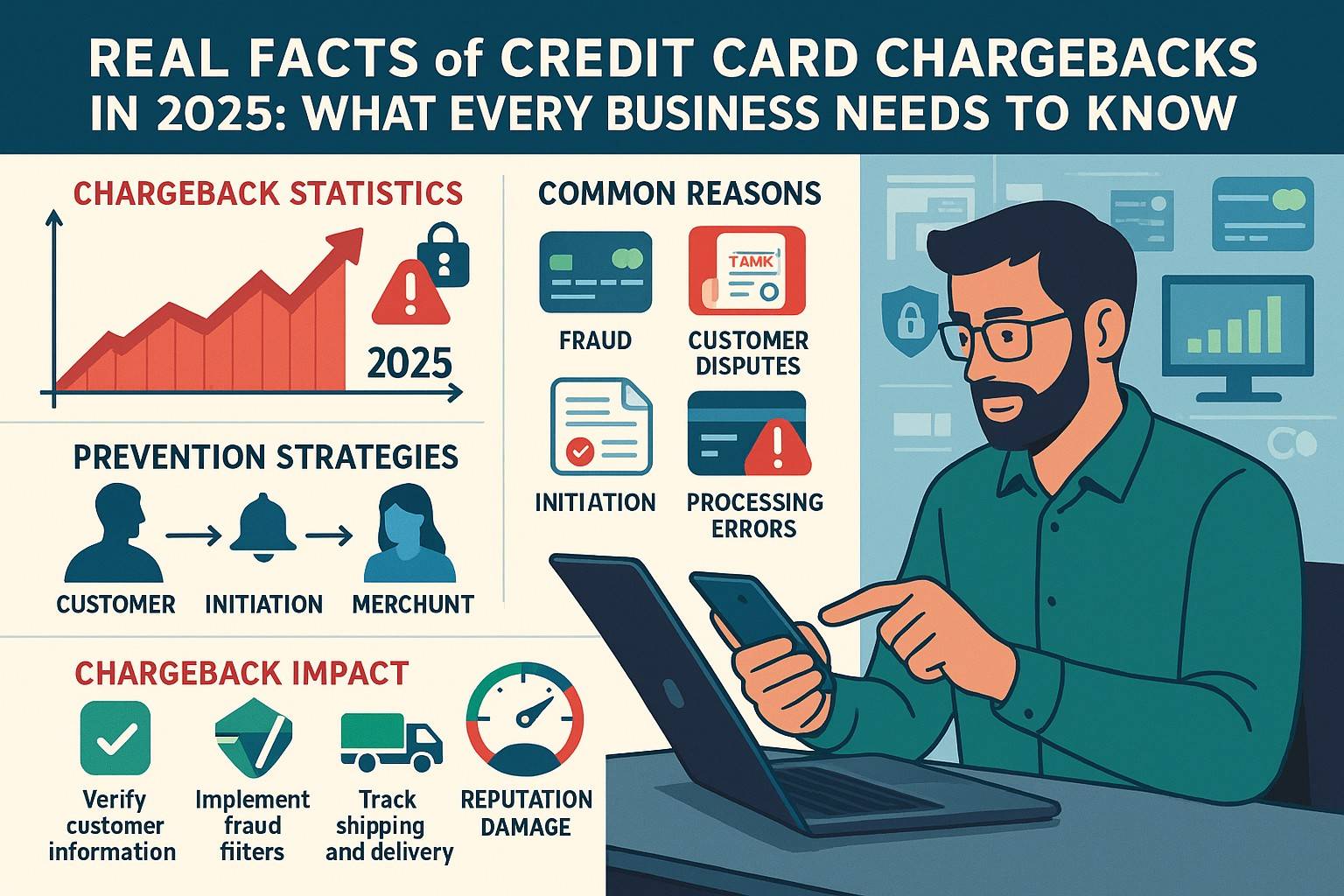

Chargebacks are a growing concern for U.S. businesses in 2025. As fraudulent activities rise, understanding the real facts about credit card chargebacks is more crucial than ever. These disputes can cause significant financial strain if not managed properly. This blog will walk you through the latest facts and best practices for reducing chargebacks and improving your bottom line.

What is a Chargeback?

A chargeback occurs when a customer disputes a transaction with their bank, and the merchant is required to refund the amount. While chargebacks are essential for protecting consumers, they can be harmful to businesses, especially in high-risk industries.

Key Facts About Chargebacks in 2025

- Chargeback Fraud is on the Rise

In 2025, fraudulent chargebacks have become a significant problem for businesses. Fraudsters often use chargebacks as a way to reverse legitimate purchases, taking advantage of lenient consumer protection policies. - The Cost of Chargebacks is Increasing

Businesses are paying a higher price for chargebacks, with the cost of handling disputes, processing fees, and potential penalties escalating each year. On average, U.S. businesses lose around 1% of their annual revenue to chargebacks. - Friendly Fraud vs. True Fraud

Friendly fraud (when a customer intentionally makes a false chargeback) is becoming more prevalent, accounting for up to 60% of all chargeback cases. This is a major challenge for businesses, as it is difficult to prove fraud without proper documentation. - Chargeback Prevention is Essential

The most effective way to reduce chargebacks is by implementing proactive prevention strategies. Utilizing advanced fraud detection tools, providing clear refund policies, and improving customer service are crucial steps in minimizing chargeback risks. - Dispute Process Changes in 2025

In 2025, financial institutions and payment processors have updated their dispute resolution processes. Merchants must stay informed about new regulations and guidelines to effectively respond to chargebacks and protect their interests.

How to Protect Your Business from Chargebacks

- Monitor Transactions

Use fraud detection tools to identify high-risk transactions and prevent chargebacks before they occur. - Enhance Customer Service

Providing exceptional customer support can often prevent disputes from escalating into chargebacks. - Maintain Clear Documentation

Ensure that you have all necessary proof of transaction, including shipping records and customer correspondence, to defend against chargeback claims.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion

Chargebacks will continue to pose a risk to U.S. businesses in 2025. By understanding the real facts about credit card chargebacks and implementing effective prevention measures, you can