Chargeback Management Services - Dispute Response Oct/ 10/ 2025 | 0

Chargebacks can significantly impact your business operations, but with the right strategies, you can reduce the risks and protect your revenue. In 2025, businesses must adapt to evolving fraud tactics and new chargeback management trends. In this guide, we’ll cover effective ways to manage and prevent chargebacks, keeping your business safe and profitable.

What Is a Chargeback?

A chargeback occurs when a customer disputes a transaction with their bank or credit card provider, resulting in a reversal of the payment. While chargebacks are sometimes legitimate, they can also stem from fraudulent activities, misunderstandings, or even customer remorse.

Why Are Chargebacks a Problem for Your Business?

Chargebacks don’t just mean losing revenue — they can also harm your reputation, increase fees, and make it harder to process payments. Too many chargebacks can lead to:

- Higher chargeback fees

- Loss of merchant account

- Damage to your credit

- Increased processing costs

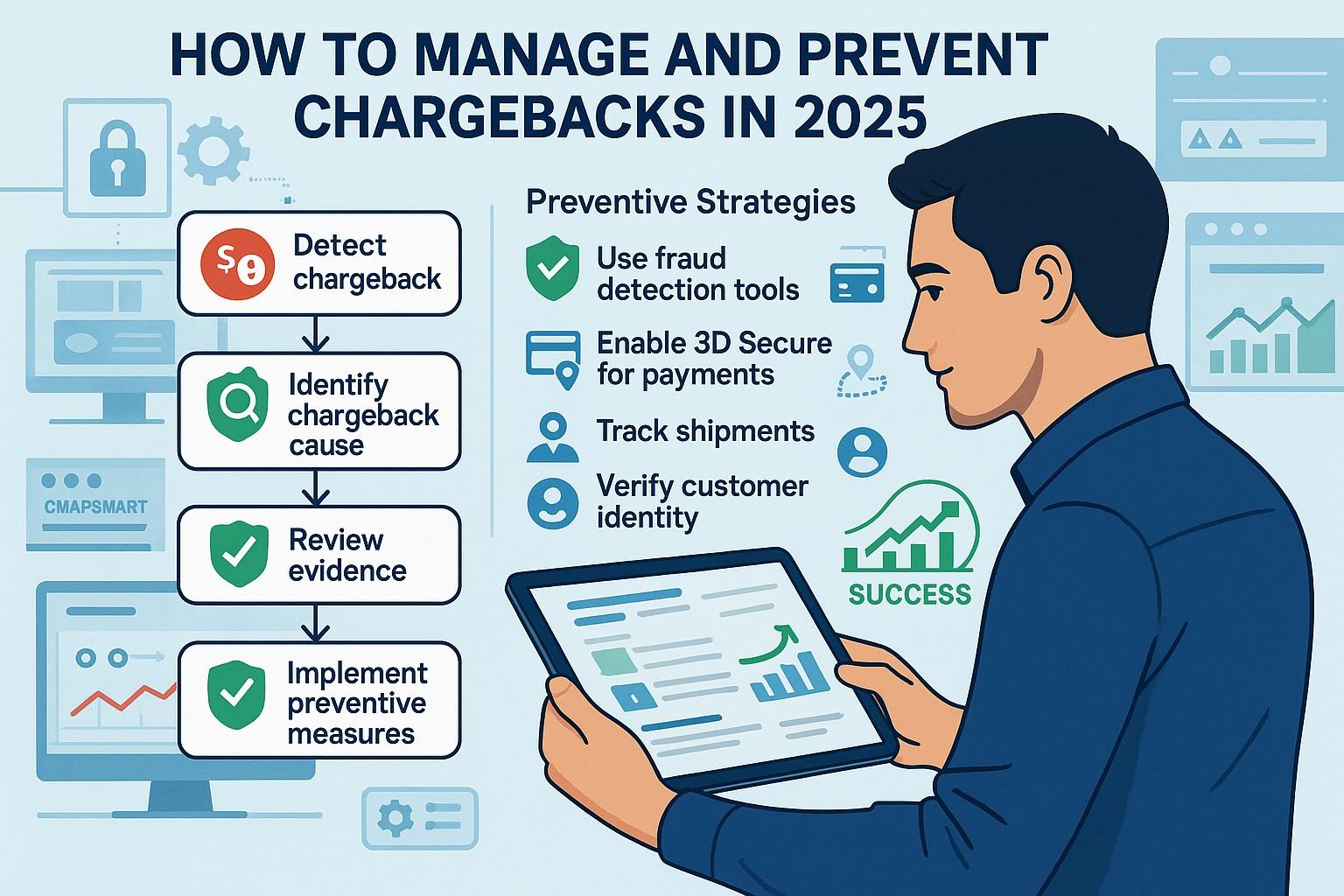

5 Proven Strategies to Prevent Chargebacks in 2025

1. Use Advanced Fraud Prevention Tools

Fraud detection technology has come a long way, and it’s crucial to stay up-to-date. Implement AI-driven tools that analyze purchasing behavior, device fingerprints, and transaction patterns to detect suspicious activities in real-time.

2. Provide Clear, Transparent Policies

A lack of clarity in return, refund, and shipping policies can often lead to chargebacks. Make sure your customers are fully aware of your policies before making a purchase. This includes:

- Clear terms and conditions

- Easy-to-find return/refund policies

- Shipping timelines

3. Maintain Excellent Customer Service

A dissatisfied customer is more likely to file a chargeback. Offering quick, friendly, and helpful customer service can resolve issues before they escalate into disputes. Consider offering multiple contact methods, such as live chat, email, or phone support.

4. Improve Payment Descriptors

A confusing payment descriptor on a customer’s credit card statement can lead to unintentional chargebacks. Ensure that the name on the statement is clear, recognizable, and includes details like your website URL or a business name that relates to the purchase.

5. Keep Comprehensive Records

Document everything! From customer correspondence to shipping information, maintaining detailed records is essential for fighting chargebacks. If a customer disputes a transaction, you’ll need this evidence to present a strong case to the bank or card issuer.

What to Do if You Receive a Chargeback?

If you face a chargeback, don’t panic. Here’s how you can handle it:

- Review the Reason Code: Understand why the chargeback was filed. This will help determine the next steps.

- Gather Evidence: Collect all relevant information, including receipts, emails, and shipment tracking.

- Submit a Response: Send a chargeback rebuttal to the card issuer with your evidence. Be sure to follow their guidelines carefully.

Why Partnering with a Chargeback Management Service is Essential

As chargeback trends evolve, so must your approach to managing them. By working with a chargeback management service, you gain access to:

- Proactive monitoring

- Real-time alerts

- Expert dispute resolution services

These services can help you minimize chargebacks and optimize your dispute response strategy.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion

Chargebacks in 2025 are an ongoing challenge for businesses. However, with the right tools and strategies, you can manage and prevent chargebacks effectively. Stay ahead of fraud trends, keep clear policies, offer top-notch customer service, and always be prepared with the proper evidence to fight disputes.

Protect your business from the financial damage of chargebacks with these proven prevention strategies!