Chargeback Management Services - Dispute Response Jul/ 21/ 2025 | 0

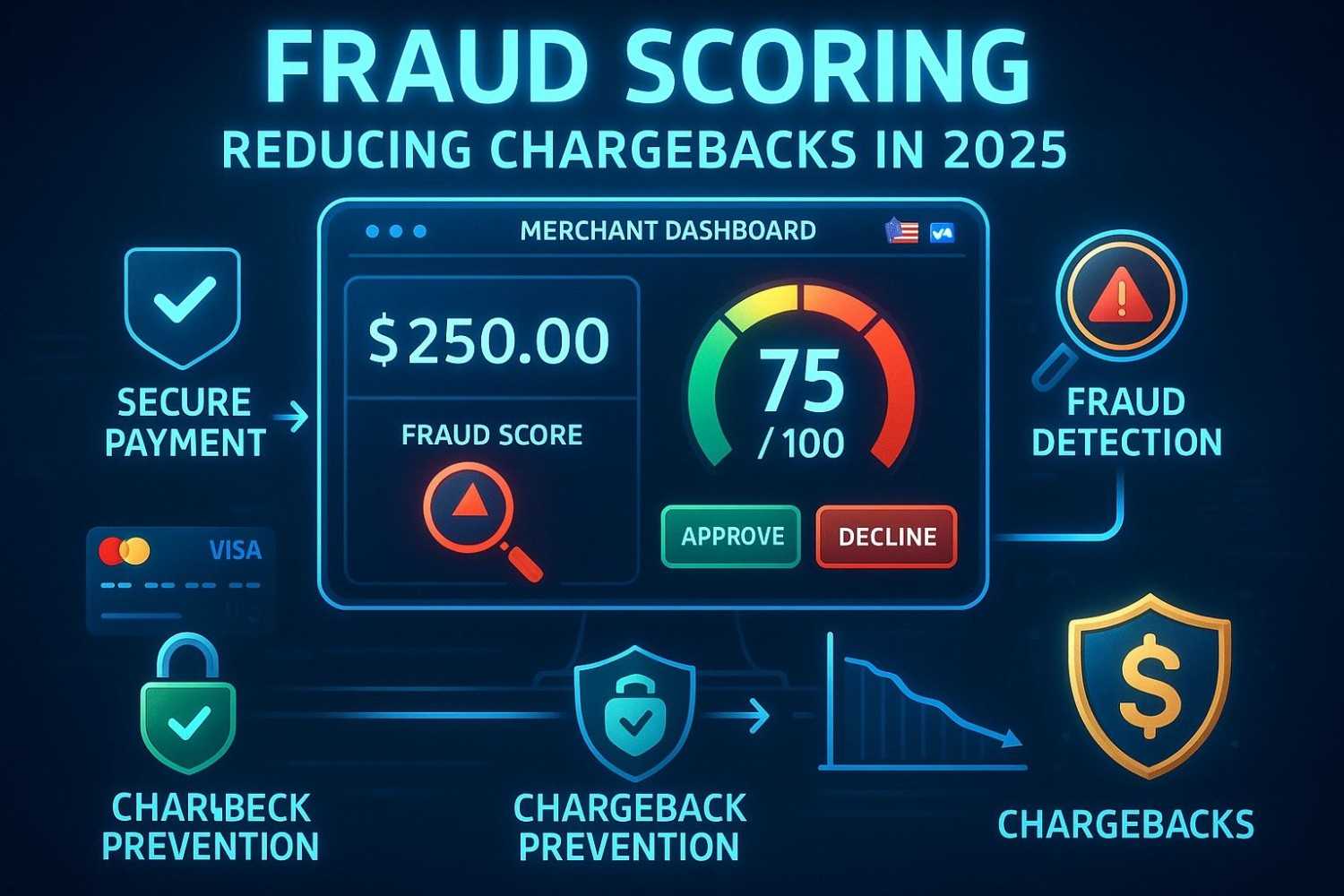

In the ever-evolving landscape of e-commerce, chargebacks remain a major challenge for U.S. businesses. One powerful tool that can help mitigate this risk is fraud scoring. By assessing the likelihood of fraud, businesses can take proactive steps to protect their revenue and prevent chargebacks before they happen. This blog explores the importance of fraud scoring in reducing chargebacks in 2025 and how it can benefit your business.

What is Fraud Scoring?

Fraud scoring is a method of evaluating the risk level associated with a transaction. By assigning a numerical score based on various risk factors, businesses can determine the likelihood that a transaction is fraudulent. This enables businesses to make informed decisions about whether to approve or decline a transaction, helping prevent chargebacks and fraudulent activities.

How Does Fraud Scoring Work?

Fraud scoring systems use algorithms that analyze multiple data points, such as:

- Customer behavior: Historical purchase patterns and frequency

- Transaction details: Location, device used, and payment method

- Risk indicators: Unusual activity or discrepancies in the transaction data

- IP and geolocation data: Discrepancies between the shipping and billing address

- Previous chargeback history: High-risk accounts are flagged for further scrutiny

These factors are combined to generate a score that indicates the likelihood of fraud. A higher score generally means a higher risk of fraud.

Benefits of Fraud Scoring for Chargeback Prevention

- Proactive Fraud Prevention: Fraud scoring allows businesses to identify high-risk transactions before they are approved, preventing chargebacks.

- Improved Decision-Making: With fraud scores, businesses can make more informed decisions on whether to process a transaction or not, reducing the chances of fraud slipping through the cracks.

- Enhanced Customer Trust: By preventing fraudulent transactions, businesses can ensure that legitimate customers are not affected by chargebacks, which helps maintain trust.

- Cost Savings: Chargeback fees, penalties, and revenue loss due to fraud can be significantly reduced with an effective fraud scoring system.

How to Implement Fraud Scoring in Your Business

- Choose a Fraud Scoring Solution: Look for fraud detection tools or payment processors that offer built-in fraud scoring services.

- Integrate with Your Payment Gateway: Ensure that the fraud scoring system integrates seamlessly with your payment gateway to analyze each transaction in real time.

- Monitor Results: Continuously track the performance of fraud scoring and make adjustments based on evolving fraud patterns and trends.

- Educate Your Team: Ensure that your team is well-trained to understand fraud scoring results and make decisions based on the data provided.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion

Fraud scoring is an essential component of any chargeback prevention strategy. By leveraging fraud scoring tools, U.S. businesses can significantly reduce the risk of chargebacks, saving money and preserving customer trust. In 2025, proactive fraud prevention is more important than ever. Ensure your business is equipped with the right tools to prevent chargebacks and protect your revenue.