Chargeback Management Services - Dispute Response Dec/ 16/ 2025 | 0

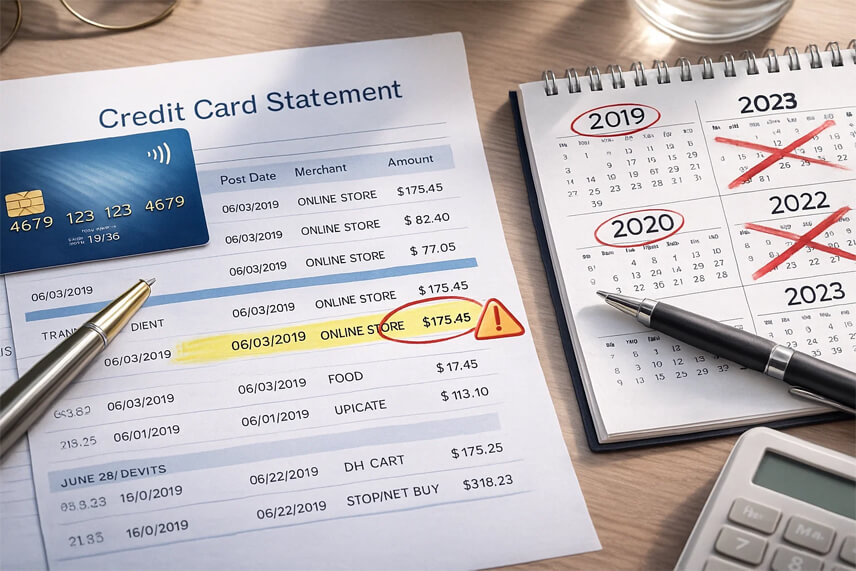

You’re scrolling through old bank statements or checking your credit report when suddenly, a charge jumps out at you—a recurring fee that should have been canceled, a mysterious payment you never authorized, or perhaps a fraudulent transaction from years ago. If you’re faced with a credit card charge that’s several years old, you might feel helpless, believing the time to file a dispute claim has long passed.

While it is true that the standard window for disputing charges is quite narrow, consumers in the USA still have avenues for relief when dealing with seriously aged transactions, especially those linked to fraud or ongoing debt collection.

Here’s a breakdown from Dispute Response on navigating the complex process of challenging charges that are years in the past.

The Hard Limits: Why Speed Matters for Most Disputes

For most consumers, the legal right to reverse a credit card transaction (known as a chargeback) is highly time-sensitive. Generally, if you find a billing error or unauthorized charge on your credit card statement, federal law requires you to file a dispute in writing within 60 days from the date the statement was issued.

If your claim relates to issues with the quality of goods or services, the timelines set by card networks like Visa and Mastercard are slightly more generous, typically allowing cardholders up to 120 days from the transaction date or delivery date to file a dispute.

These limitations are in place to ensure disputed transactions are settled quickly, but they mean that a legitimate chargeback request for an ordinary purchase or billing error cannot typically be initiated through the credit card issuer if the transaction is several years old. If you miss the time limit deadline, you generally lose the right to initiate a chargeback through your bank to recover the funds.

Where Hope Lies: Exceptions for Aged Charges

When a charge is years old, the traditional chargeback door is usually closed, but there are specific scenarios where specialized protections kick in, often moving the focus from the card issuer to federal consumer protection laws and credit reporting agencies.

1. Undiscovered Identity Theft and Fraud

If the ancient charge is the result of identity theft, you have a much stronger recourse, even years later. Identity theft victims often do not discover fraudulent accounts until they appear on their credit reports long after the fact.

If you are a victim of identity theft, you have the right to get fraudulent information permanently blocked from appearing on your credit report under the Fair Credit Reporting Act (FCRA). This process involves providing proof of your identity and an Identity Theft Report (often filed with the FTC) to the Credit Reporting Agencies (CRAs). Once fraudulent information is blocked, companies generally cannot try to collect the resulting debt from you.

For existing accounts that were misused—a common form of identity theft—you should notify the creditor immediately to explain the identity theft and direct them to close the account and remove the unauthorized charges.

2. Ongoing Recurring Charges

If the issue is a subscription or recurring charge that should have been canceled years ago but continued billing, the complexity increases. While American Express, for example, has imposed a 120-day limit for filing most chargebacks, one consumer found that Amex could generally only provide a refund for charges dating back about 60 days when attempting to dispute a long-running, unauthorized recurring membership.

However, successfully documenting that the merchant acknowledged your cancellation but continued charging you may give you additional leverage, possibly even requiring you to pursue the merchant directly in court for unauthorized charges outside the bank’s dispute window.

3. Extremely Delayed Delivery

In rare instances concerning undelivered goods, the dispute timeframe might extend significantly. Certain policies related to chargebacks for undelivered merchandise state that the payment dispute time limit shouldn’t exceed 540 days from the transaction date. While this is still not “several years,” it is a long extension beyond the standard four months typically allowed by card networks.

When the Charge Becomes Debt: The Statute of Limitations

If the “several years old” charge went unpaid, it likely transitioned from a simple transaction dispute to a debt collection issue.

For older debts, understanding the Statute of Limitations (SOL) is critical. The SOL is a state law that sets a deadline for how long lenders and collection agencies have the right to sue a consumer for nonpayment. In the USA, this timeframe varies widely by state and by the type of debt, generally ranging from three years to ten years for credit card or “open-ended” accounts.

If the SOL expires (the debt becomes “time-barred”), the debt collector can no longer take legal action against you to force payment, though you still technically owe the debt, and collection attempts may continue. If you are sued for a time-barred debt, appearing in court and using the “time-barred defense” should lead to the case being dismissed.

Keep in mind that delinquent debt remains on your credit report for seven years, regardless of whether the SOL has expired.

Your Expert Partner in Complex Disputes

Disputing charges that are several years old requires deep knowledge of complex legal frameworks, including federal laws like the FCRA, state-specific Statute of Limitations, and the rules of various card networks and issuers. Without professional assistance, it is extremely easy to miss a crucial deadline or fail to present the correct legal argument, resulting in an automatic loss.

At Dispute Response, we specialize in navigating this confusing landscape. We handle complex claims that fall outside the typical 60 or 120-day window, helping you maximize your chances of success, especially when dealing with long-term identity theft fallout, forgotten recurring bills, or hostile debt collectors.

If you have a challenging dispute claim involving aged charges, don’t assume your options are exhausted. Dispute Response compiles the compelling evidence needed to support your case and guides you through the intricate process of engaging creditors, card networks, and credit reporting agencies to fight for your financial health.

Ready to take on that long-forgotten charge? Contact Dispute Response today to learn how we can help you turn back time on your billing errors.