Chargeback Management Services - Dispute Response Oct/ 9/ 2025 | 0

What Is a Credit Card Dispute?

A credit card dispute occurs when a cardholder challenges a transaction on their statement, often because of fraud, billing errors, or unrecognized charges. In most cases, this triggers a chargeback, temporarily reversing the transaction while the issue is investigated.

Why It Matters in 2025

With the rise in friendly fraud and digital transactions, understanding the credit card dispute resolution process is essential for businesses. Ignoring it can mean revenue loss, increased processing fees, and potential account termination.

Key Parties in a Dispute

- Cardholder: Initiates the dispute

- Issuing Bank: Represents the customer

- Merchant (You): Must respond with compelling evidence

- Acquirer/Processor: Manages the communication

- Card Networks (Visa, Mastercard, etc.): Sets rules and final resolutions if escalated

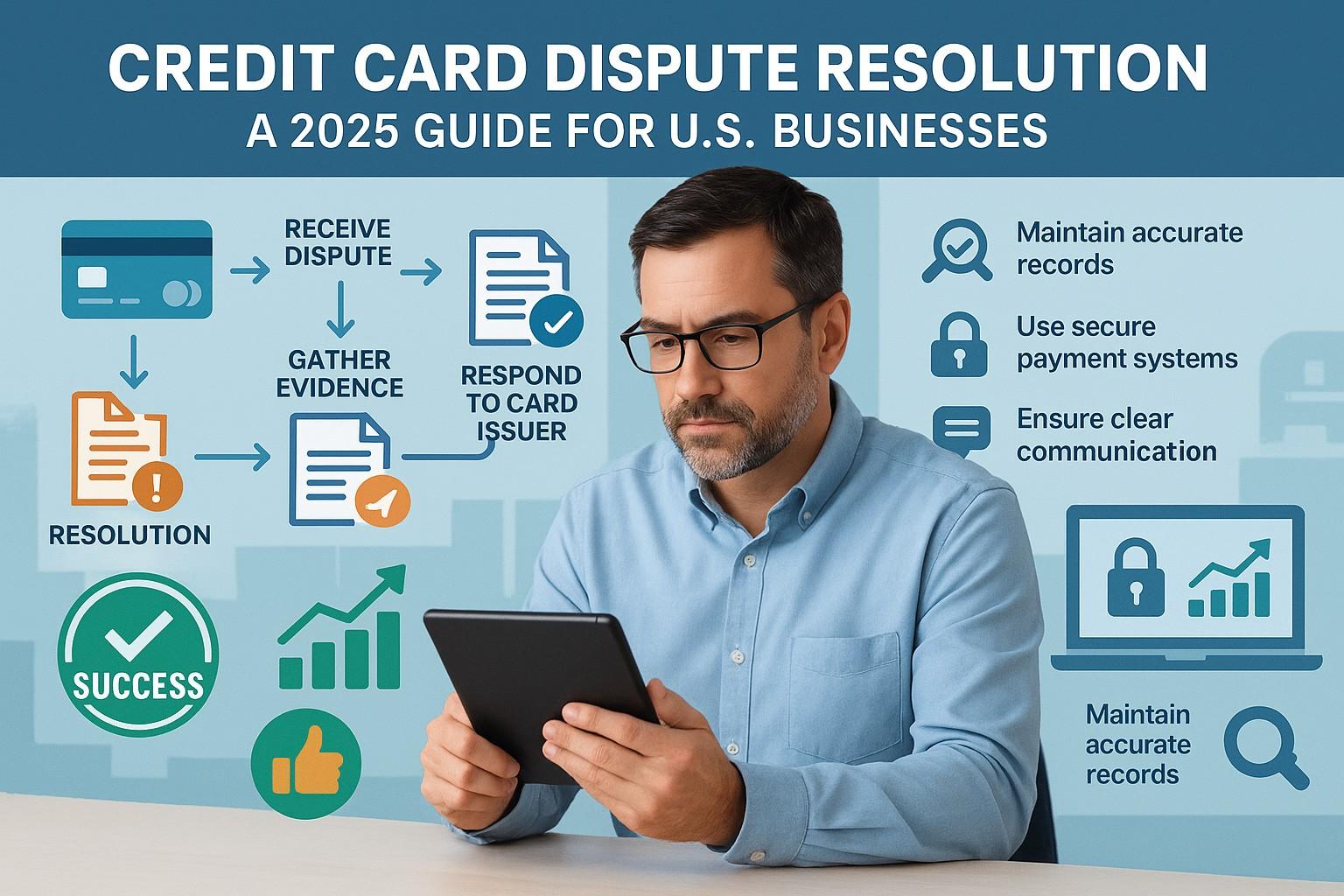

The 2025 Credit Card Dispute Resolution Process

1. Transaction Occurs

Customer makes a purchase using their credit card.

2. Dispute Is Filed

Cardholder contacts their issuing bank and claims the transaction was unauthorized, incorrect, or unsatisfactory.

3. Provisional Credit Issued

The cardholder typically receives a temporary refund from their bank while the investigation proceeds.

4. Merchant Notification

You’re notified via your processor or chargeback alert system and given a deadline to respond.

5. Submit Representment (Your Defense)

As a merchant, you can fight the dispute with documents like:

- Proof of delivery or services rendered

- Signed receipts or agreements

- Communication records

6. Decision by Issuer

If your evidence is strong, the dispute is resolved in your favor. If not, the cardholder keeps the refund.

7. Arbitration (Optional)

If either party disagrees, the case can be escalated to the card network (Visa, Mastercard) for a final ruling.

How Long Does the Process Take?

- Initial response window: 7–30 days

- Full resolution: 30–90 days, sometimes longer in arbitration cases

Common Dispute Reasons in 2025

- Unauthorized transaction (fraud)

- Item not received or defective

- Duplicate charges

- Canceled subscriptions not refunded

- Misleading product descriptions

How to Prevent Disputes

- Use clear product descriptions and transparent billing

- Send order and shipping confirmations

- Implement fraud detection and AVS tools

- Offer fast, friendly customer service

- Use chargeback alert tools like Verifi or Ethoca

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Final Thoughts

In 2025, credit card disputes are more common—and more complex—than ever. By understanding the process and proactively protecting your business, you can minimize losses and keep your merchant account healthy.