Chargeback Management Services - Dispute Response Sep/ 7/ 2025 | 0

Chargebacks are a significant concern for U.S. businesses, especially in the e-commerce space, where disputes are increasingly common. In 2025, handling chargebacks efficiently is crucial for minimizing financial loss and maintaining customer satisfaction. This guide provides businesses with the latest strategies to respond to chargebacks, prevent fraudulent claims, and enhance customer experience.

What is a Chargeback?

A chargeback occurs when a customer disputes a transaction with their bank, leading to a reversal of funds. This process is meant to protect consumers, but it can cause challenges for businesses, particularly when disputes arise over legitimate charges.

Understanding the Chargeback Process in 2025

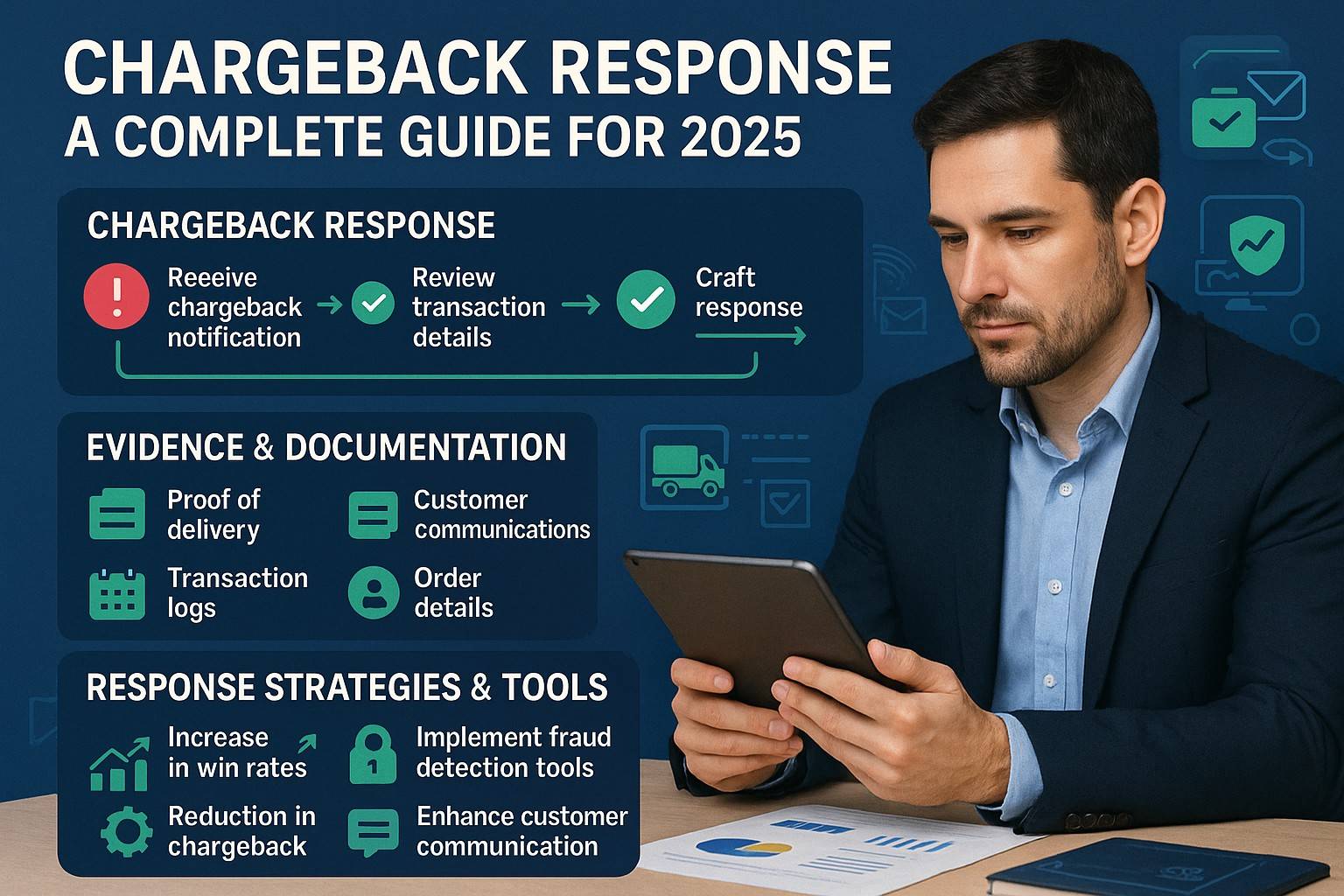

The chargeback process has evolved, with increased automation and more advanced fraud detection systems in place. Here’s a breakdown of the key stages:

- Initiation: The customer disputes the charge, usually citing reasons like fraud, dissatisfaction, or technical errors.

- Investigation: The bank reviews the claim, and if the chargeback is found valid, the funds are reversed.

- Representment: The merchant can challenge the chargeback by providing evidence that the transaction was legitimate.

How to Respond to Chargebacks Effectively

1. Understand the Reason Codes

Each chargeback comes with a reason code that specifies why the customer initiated the dispute. Familiarizing yourself with these codes will help tailor your response more effectively.

2. Collect and Present Strong Evidence

Gather all relevant documentation to prove the validity of the transaction. This can include:

- Customer communication

- Proof of delivery

- Signed contracts or receipts

3. Leverage Technology

Utilize chargeback management tools and AI-powered fraud detection systems to identify suspicious transactions before they escalate.

4. Respond Quickly

Timely responses are crucial. Most chargeback systems have a strict window for submission, typically between 7 to 30 days. Missing this window could result in a loss of the dispute.

Chargeback Prevention: Proactive Measures

Preventing chargebacks before they occur is far more effective than managing them post-transaction. Here are some strategies:

- Clear Policies: Ensure that your return and refund policies are easy to find and understand on your website.

- Customer Verification: Use address verification and 3D Secure protocols to authenticate transactions.

- Fraud Prevention Tools: Integrate fraud prevention solutions like Verifi or Ethoca into your checkout process.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion

Handling chargebacks effectively in 2025 requires a blend of knowledge, technology, and proactive strategies. By responding promptly, using the right tools, and ensuring clear communication with customers, U.S. businesses can safeguard their revenue and reputation.