Chargeback Management Services - Dispute Response Jul/ 12/ 2025 | 0

In 2025, chargebacks remain one of the biggest threats to revenue and merchant account health for U.S. e-commerce businesses. Whether caused by friendly fraud, true fraud, or merchant error, chargebacks can damage both your bottom line and reputation.

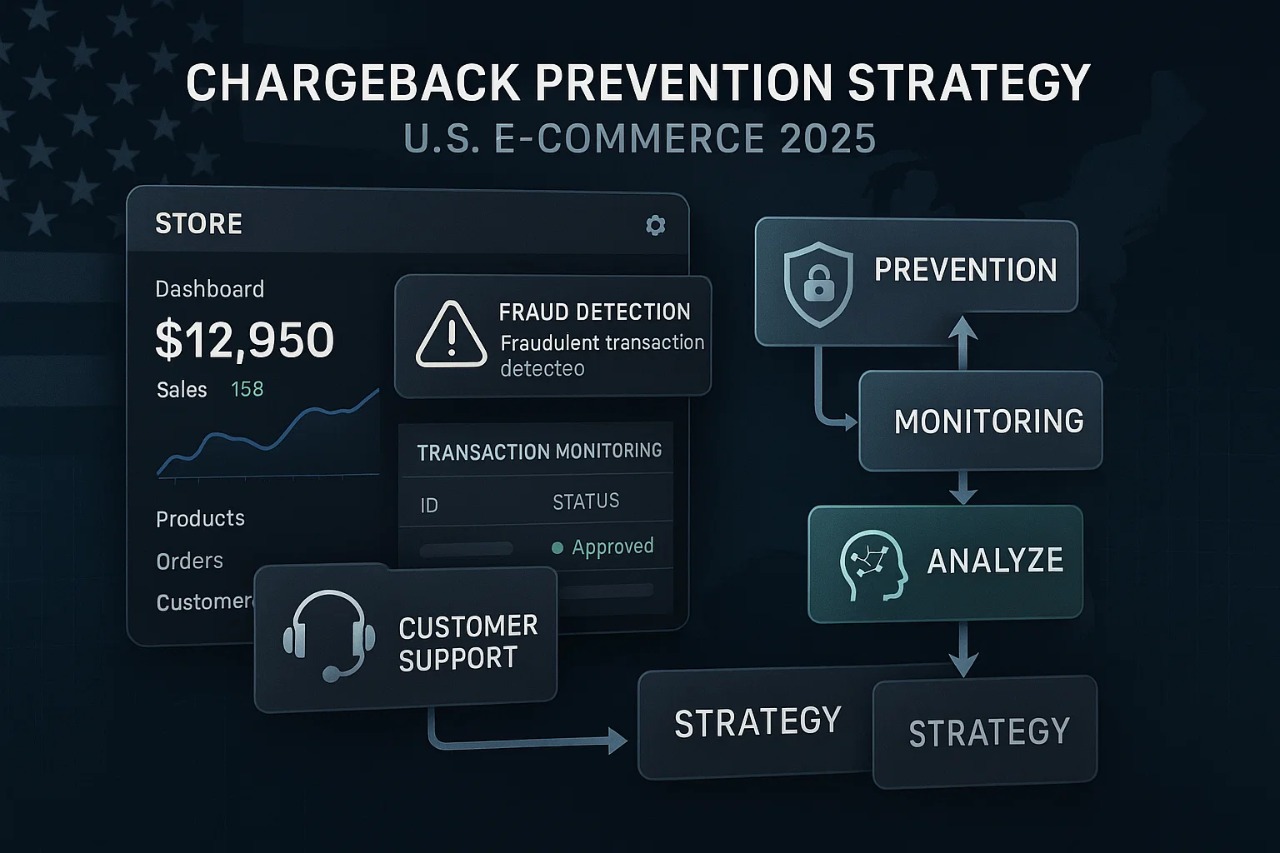

Building a strong chargeback prevention strategy isn’t optional—it’s essential.

Why Chargeback Prevention Matters More Than Ever in 2025

The Growing Cost of Chargebacks

Chargeback fees have increased across most major processors. Combined with lost product, shipping, and admin time, the average cost per chargeback is now 1.5x the original sale value.

Impact on Merchant Accounts

Too many chargebacks can flag your business as high-risk, leading to payment processor penalties, account freezes, or even termination.

Key Elements of a Strong Chargeback Prevention Strategy

1. Transparent Business Practices

Clarity builds trust and reduces customer disputes.

- Use clear product descriptions

- Highlight refund and return policies

- Display contact info and support channels prominently

2. Reliable Order Fulfillment

Late or inaccurate deliveries trigger disputes.

- Partner with trusted fulfillment providers

- Provide real-time tracking

- Offer delivery notifications and confirmation

3. Enhanced Customer Support

Quick resolutions can stop a complaint from becoming a chargeback.

- Offer 24/7 support via email, chat, or phone

- Empower agents to resolve disputes proactively

- Monitor complaint trends and fix recurring issues

4. Use Chargeback Alerts & Early Detection Tools

Prevent a chargeback before it happens.

- Integrate with tools like Ethoca or Verifi

- Set up real-time alerts and automatic refunds

- Respond immediately to inquiries or refund requests

5. Implement Fraud Prevention Measures

Stop fraudulent transactions at the source.

- Use AVS (Address Verification System) and CVV checks

- Deploy AI-based fraud detection platforms

- Block high-risk geographies or IPs

6. Optimize Billing Descriptors

Avoid confusion on bank statements.

- Use a recognizable business name

- Include a customer service

- Keep descriptors consistent across platforms

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

7. Maintain Detailed Records

If a chargeback happens, evidence matters.

- Save receipts, shipping records, and customer communication

- Log IP addresses, timestamps, and geolocation data

- Store screenshots of product pages and T&C acceptance

Bonus: Train Your Team

Invest in regular training for your customer service and fulfillment teams. Make sure they understand:

- Chargeback triggers

- How to respond to disputes

- How to spot potential fraud

Monitor & Adjust Your Strategy Regularly

A strong chargeback prevention strategy in 2025 must be data-driven and flexible.

- Review chargeback data monthly

- Identify patterns and root causes

- Adjust processes accordingly

Final Thoughts

Preventing chargebacks in 2025 is no longer just about fighting fraud—it’s about delivering an excellent end-to-end customer experience. With the right tools, support systems, and proactive strategies in place, U.S. e-commerce firms can reduce risk protect profits, and scale confidently.