Chargeback Management Services - Dispute Response Aug/ 4/ 2025 | 0

Chargeback fraud is a significant threat to businesses in 2025, with rising instances of “friendly fraud” causing severe financial losses. As fraud tactics evolve, it’s essential for U.S. businesses to stay ahead of the curve by implementing effective chargeback fraud prevention strategies. This comprehensive guide will walk you through everything you need to know to protect your revenue and reputation.

Understanding Chargeback Fraud

What is Chargeback Fraud?

Chargeback fraud occurs when a consumer falsely disputes a legitimate transaction, leading to the merchant losing both the product and the payment. This can happen due to various reasons, such as misunderstanding of transaction details or deliberate fraud attempts.

Types of Chargeback Fraud

- Friendly Fraud: The customer makes a legitimate purchase but later falsely claims that the transaction was unauthorized.

- Criminal Fraud: A fraudster uses stolen credit card details to make a purchase and then initiates a chargeback.

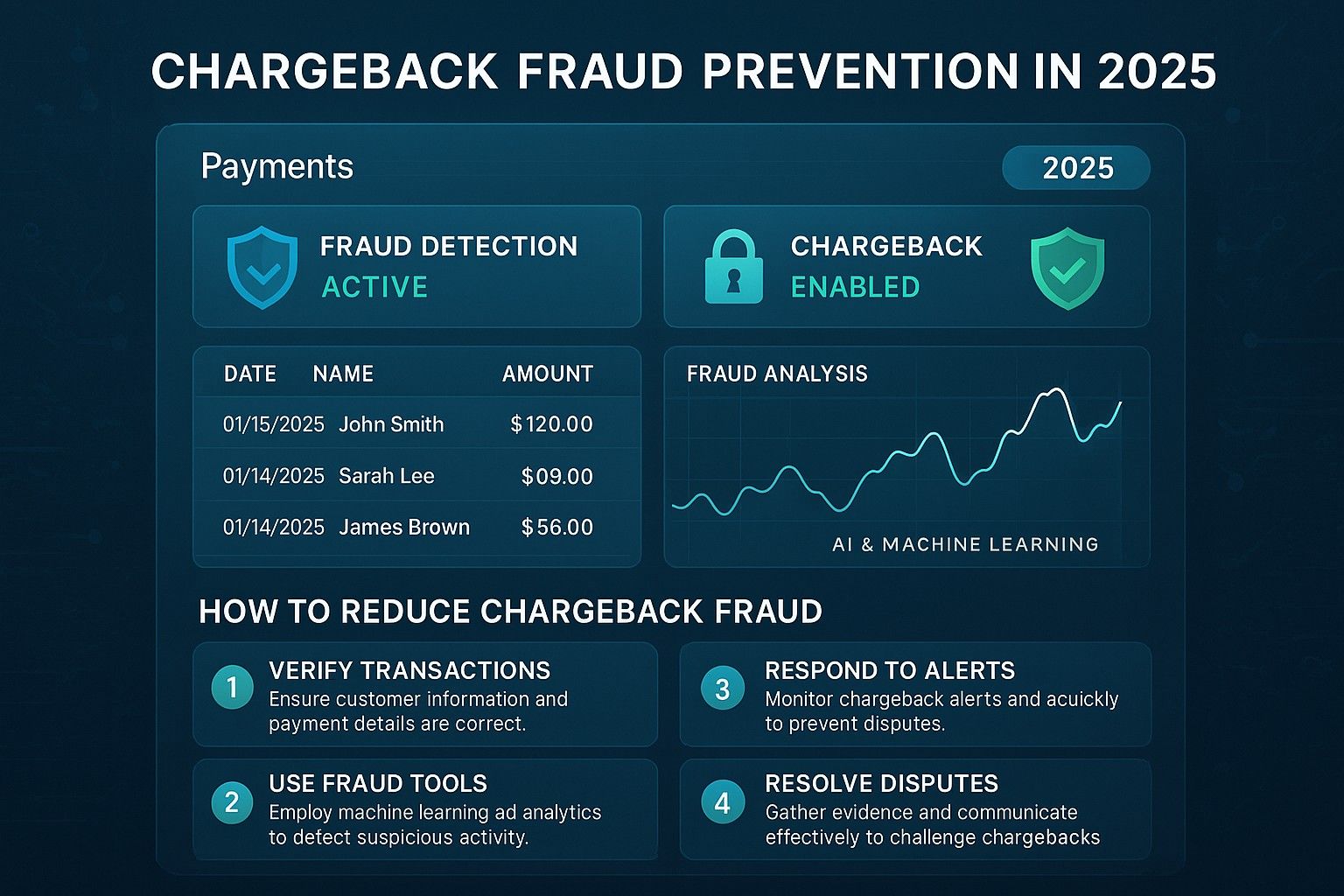

Strategies for Chargeback Fraud Prevention

1. Implement Advanced Fraud Detection Tools

Leveraging fraud detection technologies, such as machine learning and AI, can help identify fraudulent transactions before they escalate to chargebacks. Tools like fraud scoring, 3D Secure 2.0, and address verification systems (AVS) add layers of protection.

2. Optimize Your Payment Processing Systems

Ensure that your payment processing platform is updated with the latest security measures, including EMV chip technology and tokenization, to reduce the risk of fraud. Use secure payment gateways that support advanced authentication techniques.

3. Strengthen Your Customer Verification Process

Verify your customers’ identity through multi-factor authentication (MFA) or email confirmation before processing transactions. This helps to ensure that the transaction is legitimate and authorized by the cardholder.

4. Maintain Clear Communication with Customers

Misunderstandings often lead to chargebacks. Clear communication regarding billing, shipping, and refund policies can prevent confusion. Providing accessible customer support can also resolve issues before they escalate to disputes.

5. Document Every Transaction

Maintaining thorough records of each transaction, including receipts, tracking numbers, and customer communication, is critical. This documentation can serve as evidence in case a chargeback dispute arises.

The Role of 3D Secure 2.0 in Chargeback Prevention

Why 3D Secure 2.0 Matters

3D Secure 2.0 is an advanced authentication protocol that helps verify the legitimacy of card transactions. By implementing this technology, merchants can reduce the likelihood of chargebacks due to unauthorized transactions. It provides a more seamless experience for customers and better protection for merchants.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion: Protect Your Business from Chargeback Fraud

In 2025, chargeback fraud prevention is more important than ever. By staying informed about fraud trends and utilizing the right prevention tools, your business can avoid the financial and reputational damage caused by chargebacks. Implement these strategies, and ensure that your business remains secure, profitable, and customer-focused.