Chargeback Management Services - Dispute Response Jul/ 14/ 2025 | 0

Chargebacks are no longer just a payment inconvenience — they are a direct threat to e-commerce profitability in 2025. U.S. retailers must adopt proactive and informed strategies to manage, respond to, and win chargeback disputes. In this guide, we break down the best practices tailored specifically for modern e-commerce businesses.

What Is a Chargeback?

A chargeback occurs when a customer disputes a credit or debit card transaction, prompting the issuing bank to reverse the charge. While designed to protect consumers from fraud, chargebacks can hurt merchants by triggering penalties, lost revenue, and excessive fees.

Why Chargebacks Are Increasing in 2025

E-commerce continues to grow, and so does fraud. With evolving consumer expectations and stricter card network rules, friendly fraud (legitimate purchases falsely reported as fraud) and subscription disputes have surged. This makes chargeback prevention and resolution more critical than ever.

Top Reasons for Chargebacks in E-Commerce

- Fraudulent Transactions

Unauthorized use of a credit card without the cardholder’s consent. - Product Not Received (PNR)

Customer claims they never received the item. - Product Not as Described

Item differs from its description or arrives damaged. - Duplicate Billing or Incorrect Amounts

Customer is charged twice or the wrong amount is debited. - Recurring Billing Issues

Subscription continues even after cancellation.

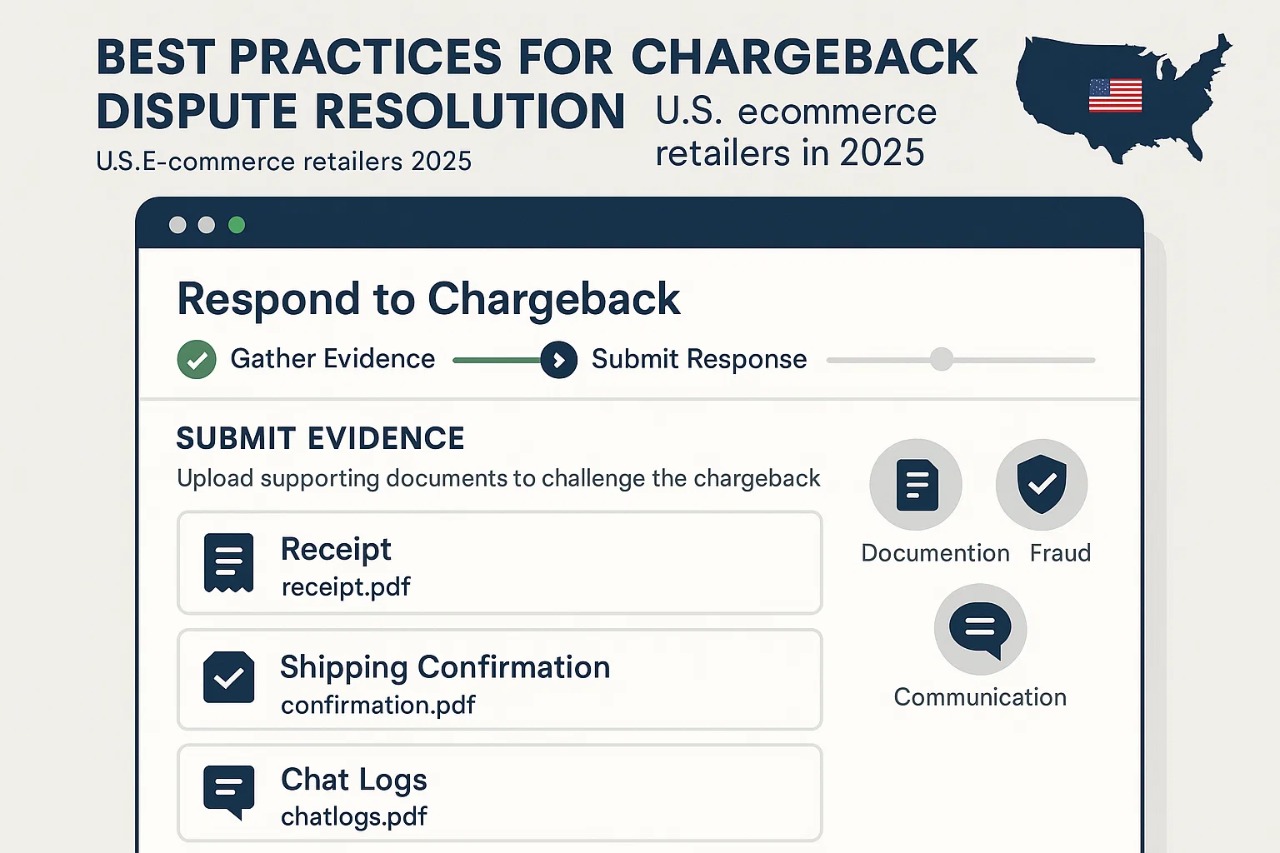

Best Practices for Resolving Chargeback Disputes

1. Gather Clear, Valid Evidence

Banks need compelling documentation to decide in your favor. Your dispute response should include:

- Order confirmation and transaction receipts

- Shipping and delivery records

- Customer communication logs

- Product descriptions and return/refund policies

2. Respond Quickly and Accurately

Deadlines are strict — often within 7–14 days. Use automation tools or partner with a chargeback management firm like Dispute Response to stay on top of timelines.

3. Use Chargeback Alerts

Early warning systems like Ethoca and Verifi notify you before a chargeback is filed, allowing you to resolve the issue directly with the customer.

4. Implement Fraud Prevention Tools

- 3D Secure (2.0) authentication

- AVS (Address Verification Service)

- CVV matching

- AI-powered fraud scoring systems

5. Train Your Support and Fulfillment Teams

Miscommunication and delays often trigger disputes. Ensure your customer service and shipping partners are aligned with your chargeback prevention efforts.

Bonus: Prevent Chargebacks Before They Happen

Prevention is cheaper than resolution. Here are a few quick wins:

- Display clear return and refund policies

- Offer real-time order tracking

- Send automated reminders for subscription renewals

- Use recognizable billing descriptors

Why Work With a Chargeback Specialist?

Navigating disputes in-house can drain resources. Dispute Response offers full-service chargeback management tailored to e-commerce businesses. From real-time alerts to compelling evidence creation, we help maximize win rates and reduce revenue loss.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Final Thoughts

Chargebacks in 2025 require a mix of technology, strategy, and experience. Whether you’re a new e-commerce seller or an established U.S. brand, adopting these best practices can help you reduce disputes, improve win rates, and protect your profits.📞 Need help fighting chargebacks?

Talk to a chargeback expert at Dispute Response