Chargeback Management Services - Dispute Response Oct/ 5/ 2025 | 0

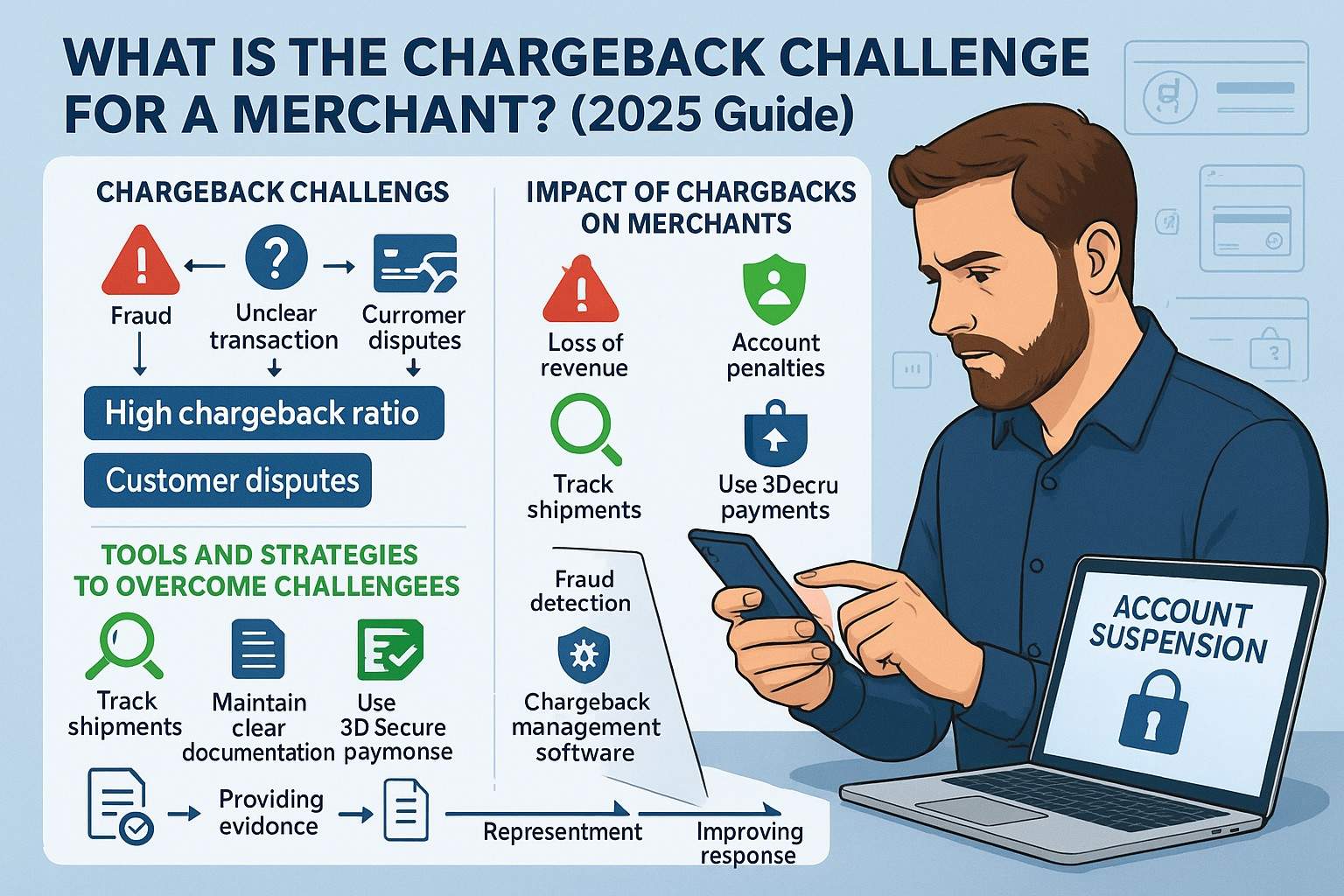

In 2025, the chargeback challenge is more than a customer dispute—it’s a growing threat to U.S. merchants’ revenue, reputation, and payment processing stability. From friendly fraud to outdated dispute systems, businesses face an uphill battle every time a chargeback hits.

Let’s break down what makes chargebacks such a challenge—and what smart merchants are doing to fight back.

🔍 Understanding the Chargeback Challenge

Chargebacks were designed as a consumer protection mechanism. But in recent years, they’ve morphed into a serious pain point for legitimate businesses.

Common Reasons for Chargebacks in 2025:

- Friendly Fraud: Customers make a purchase, receive the product, and still file a dispute.

- Merchant Error: Poor billing descriptors, duplicate charges, or delayed refunds.

- Criminal Fraud: Stolen card information used without the cardholder’s knowledge.

⚠️ Why Chargebacks Are a Major Problem for Merchants

Each chargeback brings more than just a refund—it includes fees, lost goods/services, increased fraud risk scores, and potential merchant account termination.

Key Consequences:

- Revenue Loss: You lose the transaction and potentially the customer.

- Reputation Damage: Too many chargebacks flag your business as high-risk.

- Processor Penalties: Exceeding thresholds (usually 1%) can get your account frozen or shut down.

🛡️ How Merchants Can Fight Back

Facing the chargeback challenge means staying proactive. Prevention and strategic response are key to surviving in the 2025 landscape.

🔧 Prevention Strategies:

- Use clear billing descriptors to avoid confusion.

- Automate fraud detection with AI-powered tools.

- Respond quickly to customer complaints and refund requests.

- Implement real-time chargeback alerts to catch disputes early.

📝 Representment Tips:

- Gather strong compelling evidence (invoices, delivery confirmations, IP logs).

- Submit on time—each chargeback reason code has strict deadlines.

- Use a chargeback management service like Dispute Response to improve win rates.

💡 Pro Tip: Outsource to Win the War

Many merchants now rely on chargeback experts to navigate the complex world of representments and disputes. Outsourcing can:

- Reduce internal overhead

- Boost recovery rates

- Keep your chargeback ratio below processor thresholds

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

✅ Conclusion: Get Ahead of the Chargeback Curve

The chargeback challenge isn’t going away in 2025. But with the right tools, strategy, and support, U.S. merchants can turn disputes from a loss into a learning opportunity—and even recover lost revenue.