Why Merchant Funds Get Frozen by Banks (2026 Guide)

Jan/ 13/ 2026 |

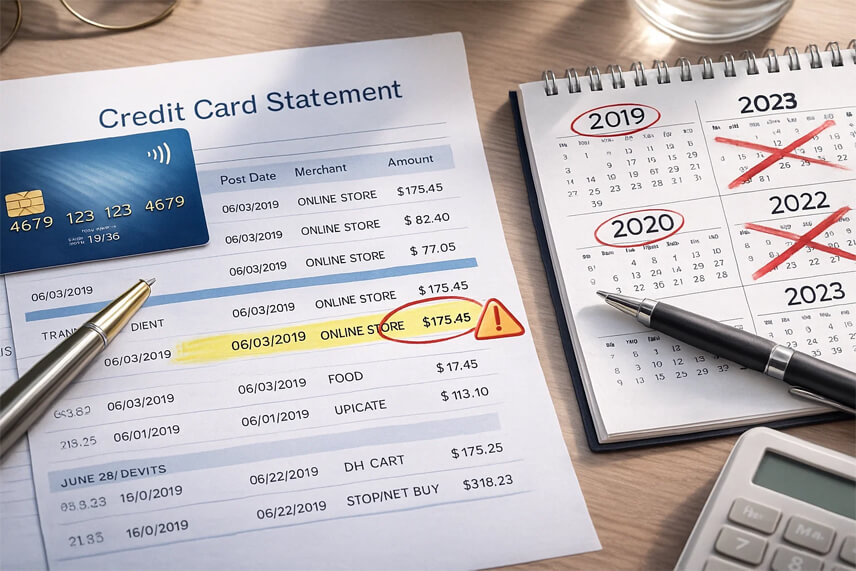

Introduction Few things are more damaging to a business than frozen merchant funds. Payroll stops, vendors go unpaid, and growth halts overnight. In 2026, banks are freezing funds more aggressively than ever due to KYB failures, dispute risk, and compliance