Chargeback Management Services - Dispute Response Sep/ 11/ 2025 | 0

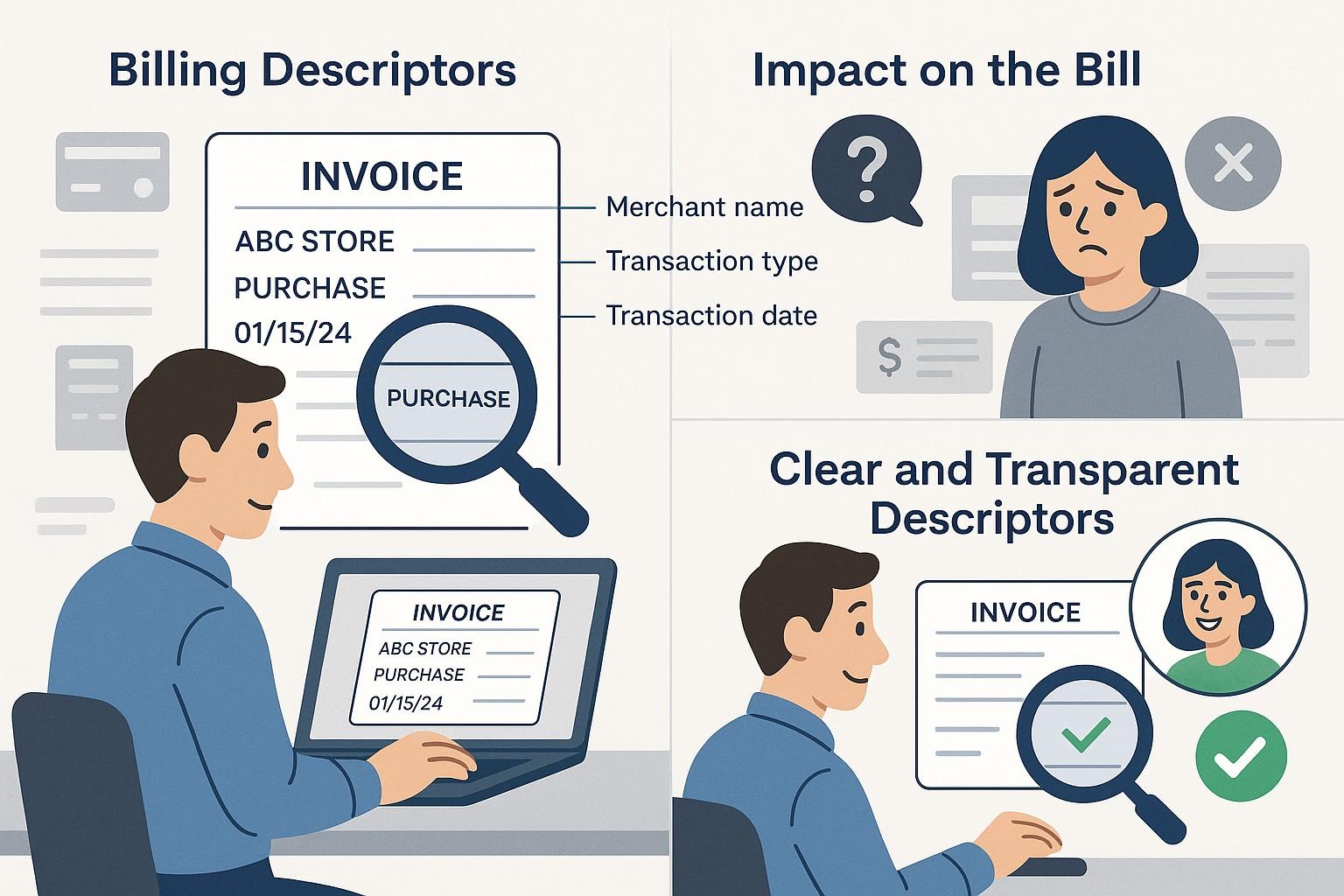

When you review your bank or credit card statement, the “billing descriptor” is the line of text that shows up next to the transaction. It can include the name of the merchant, a business identifier, or even a contact number. While it may seem like just a detail, billing descriptors play a significant role in the payment process—particularly when it comes to chargebacks. Understanding what these descriptors mean for your business and customers is crucial for avoiding disputes.

What is a Billing Descriptor?

A billing descriptor is the text that appears on a customer’s bank or credit card statement after they make a purchase. This descriptor helps the customer identify the source of the charge. It typically includes:

- Merchant’s name

- Contact information

- A brief description of the product or service

Why Do Billing Descriptors Matter?

The clarity of the billing descriptor can directly influence how a customer perceives the charge. A confusing descriptor may prompt a customer to initiate a chargeback. A clear, recognizable billing descriptor reduces the risk of misunderstandings.

Common Types of Billing Descriptors

- Merchant Name and Location:

This is the most straightforward type of descriptor, typically listing the business name and the city or region where it’s located. - Product or Service Description:

For businesses that sell specific items, this type of descriptor includes a brief description of the product or service purchased. - Customer Service Contact Info:

Including customer service numbers or email addresses in your billing descriptor can help customers resolve concerns without disputing the charge.

The Importance of Billing Descriptors for U.S. Businesses

In 2025, the role of billing descriptors has become even more crucial in preventing disputes. With chargebacks on the rise, merchants need to ensure their billing descriptors are clear and accurate. Here’s why it matters:

- Preventing Chargebacks:

A clear billing descriptor reduces the likelihood of chargebacks. If customers can quickly recognize the charge, they are less likely to dispute it. - Customer Trust:

An accurate billing descriptor builds trust and transparency, which is key for repeat business and customer satisfaction. - Legal Compliance:

In the U.S., merchants must ensure their billing descriptors are compliant with financial regulations to avoid penalties and legal complications.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

How to Set Up Clear Billing Descriptors

To ensure your billing descriptors work for both you and your customers, follow these best practices:

- Be Specific:

Use clear, detailed descriptors that leave no room for confusion. Include your business name and any relevant information that ties the charge to the purchase. - Update Information Regularly:

Make sure the descriptor information on file with your payment processor is up-to-date. Any changes in business name, address, or contact information should be reflected immediately.

Use Multiple Channels for Support:

Include contact details like phone numbers or email addresses so customers can easily reach you if they have questions.