Chargeback Management Services - Dispute Response Feb/ 3/ 2026 | 0

Introduction

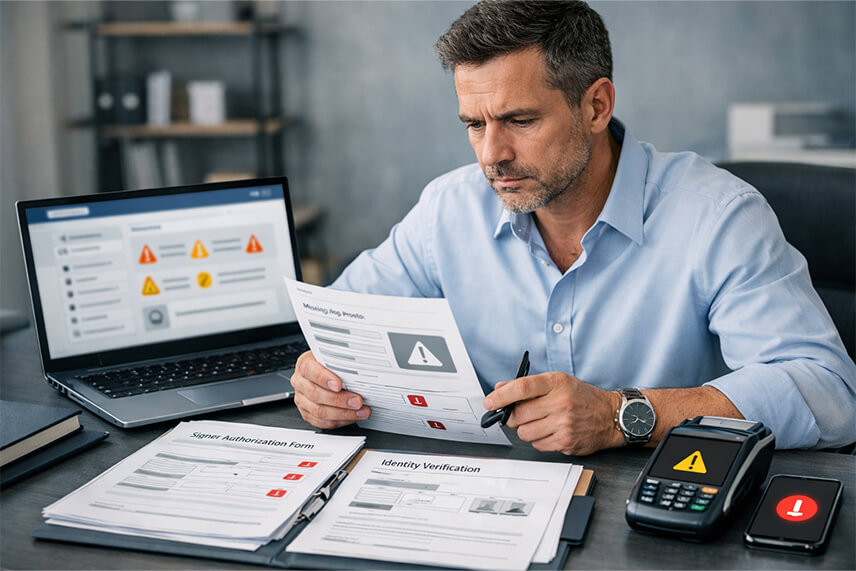

When a bank requests SSN or signer verification, it is not optional. Missing or incomplete identity data is treated as a critical KYB failure, often leading to account holds or frozen funds.

This article explains what happens when SSN or signer information is missing, and how merchants can resolve the issue before it escalates.

Why SSN & Signer Verification Matters

Banks must verify who controls the business, who has the authority to move funds, and who is legally accountable for transactions. These identity checks are mandatory under federal AML regulations and are strictly enforced by all payment processors.

What Happens When Information Is Missing

Step 1: Compliance Request Issued

When required information is missing, processors issue a formal compliance request asking for SSN verification, valid government-issued identification, and proof of signing authority. A clear response deadline is usually provided.

Step 2: Account Restrictions

If the request is ignored or delayed, processors may restrict the account by delaying payouts, applying transaction limits, or partially holding funds to reduce exposure.

Step 3: Full Account Hold

Continued non-response or incomplete submissions often lead to a full account hold. At this stage, funds may be frozen, transactions blocked, and the account may face termination risk.

How to Fix Missing SSN or Signer Issues

Step 1: Identify Required Individuals

Processors typically require verification for any individual owning 25% or more of the business, authorized signers, and managing members who control daily operations.

Step 2: Submit Complete Verification

Merchants must submit full SSNs (not partial digits), valid photo identification, and current proof of address for each required individual. Partial or incorrect submissions significantly extend review timelines.

Step 3: Submit an Explanation Letter

A short explanation should clearly outline the role of each signer, confirm legal authority over the account, and verify that no undisclosed ownership exists.

Preventing Future Identity Issues

To prevent future issues, merchants should disclose all owners during onboarding, keep signer information updated at all times, and notify processors immediately when ownership or authority changes occur.

When Escalation Is Needed

If processors stop responding or the account remains restricted beyond standard review timelines, professional escalation can help resolve the issue faster.

👉 Dispute Response helps merchants resolve signer issues, restore processing, and release frozen funds.

Final Thoughts

Missing SSN or signer data does not imply wrongdoing, but delays and lack of response increase perceived risk. Fast, accurate, and complete submissions help merchants avoid shutdowns and financial disruption.