Chargeback Management Services - Dispute Response Oct/ 6/ 2025 | 0

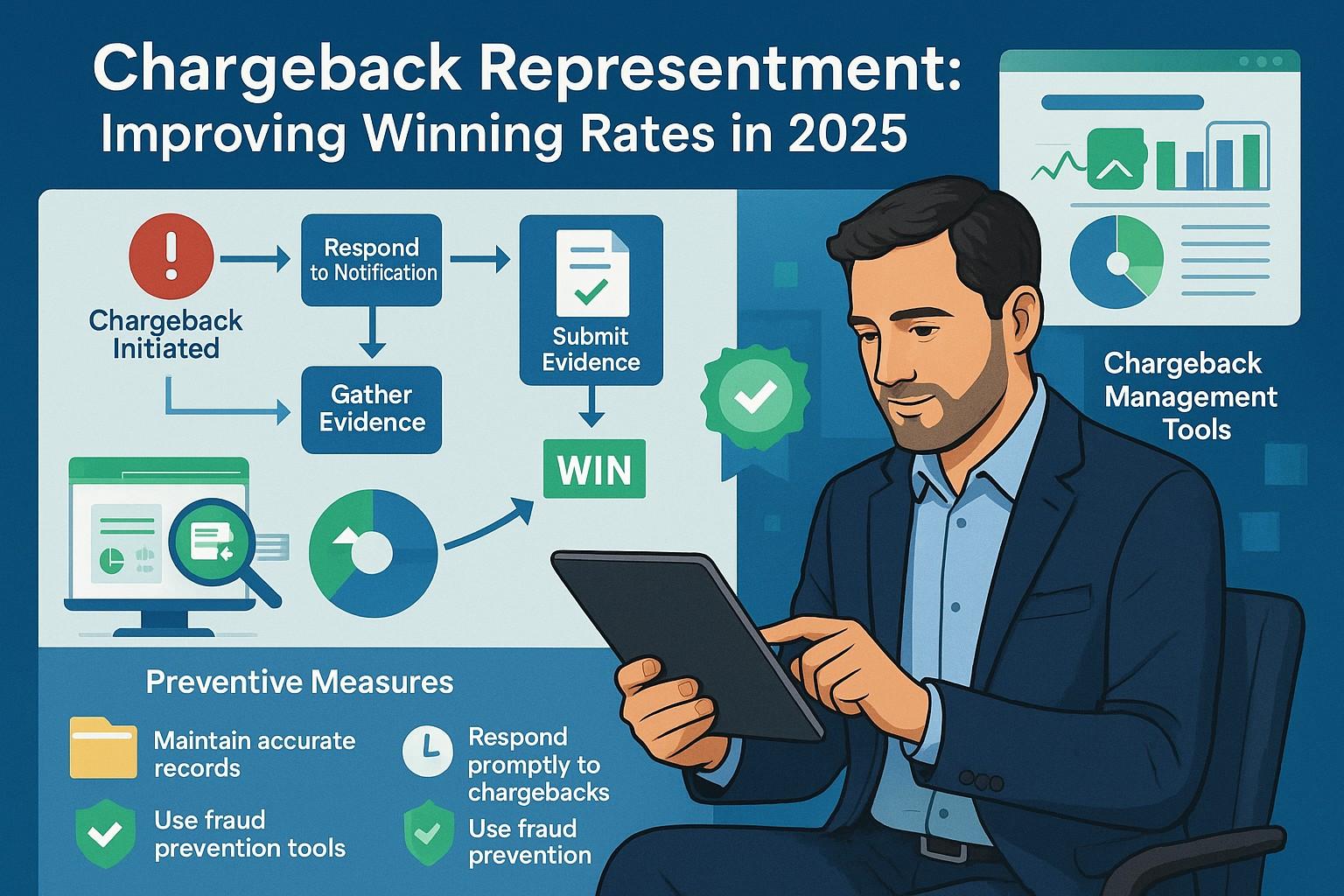

Chargebacks remain a significant concern for U.S. businesses in 2025. However, with the right strategies and understanding of representment, businesses can increase their chances of winning chargeback disputes and recover lost revenue. This blog explores effective techniques to enhance your chargeback representation success.

What is Chargeback Representation?

Chargeback representation is the process through which a merchant disputes a chargeback by providing evidence to prove that the transaction was legitimate. If done correctly, representment can reverse the chargeback and reinstate the transaction.

- Key Elements of Chargeback Representment:

- Documentation: Providing solid evidence to show the transaction was valid.

- Timeliness: Responding promptly to chargeback notifications.

- Clear Communication: Ensuring that all details are clearly outlined in your representment submission.

- Documentation: Providing solid evidence to show the transaction was valid.

Why Winning Chargebacks Matters

Winning chargebacks is crucial for your business’s financial health. Every chargeback means lost revenue and potential fees. Moreover, frequent chargebacks can damage your relationship with payment processors, leading to higher fees or even account termination.

Key Benefits of Successful Representment:

- Revenue Recovery: Winning a chargeback dispute means retaining funds that would otherwise be lost.

- Reduced Risk of Penalties: Low chargeback ratios keep your merchant account in good standing, reducing the risk of penalties.

- Enhanced Customer Trust: Effective dispute resolution can maintain customer relationships, as it demonstrates fairness and professionalism.

Strategies for Improving Chargeback Representment Success

In 2025, businesses need to stay proactive and adopt strategies to improve their chargeback representment success. Here are key techniques to enhance your chances:

1. Build a Strong Case with Evidence

- Provide detailed evidence such as transaction records, delivery confirmations, signed receipts, and customer communication.

- Use tools like AI-driven fraud detection to gather data points that support your case.

2. Know the Chargeback Reason Codes

- Different chargebacks have specific reasons and corresponding evidence requirements. Understanding these codes ensures you submit the right documentation to address the specific issue.

3. Act Quickly and Submit Timely Responses

- Timely submission of your representment documents is critical. Missing deadlines can result in automatic loss of the dispute.

4. Leverage Technology and Automation

- Use automated tools for monitoring chargebacks and managing disputes. Automation can streamline evidence collection, making your response process more efficient.

5. Develop a Preventative Strategy

- Prevention is always better than dealing with chargebacks. By improving fraud detection, offering clear refund policies, and maintaining transparent customer service, you can reduce the occurrence of chargebacks.

Common Mistakes to Avoid in Chargeback Representment

While representment can be a valuable tool, it’s essential to avoid some common mistakes that could undermine your success:

- Inadequate Documentation: Failing to submit the correct or complete evidence can result in a lost dispute.

- Missed Deadlines: Delays in responding to chargebacks can prevent your case from even being considered.

- Ignoring Chargeback Reason Codes: Not tailoring your response to the specific chargeback reason code may lead to an unsuccessful representment.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Conclusion: Mastering Chargeback Representment

Chargeback representment is a crucial process for U.S. businesses in 2025. By implementing the right strategies, understanding the chargeback reasons, and providing solid evidence, businesses can improve their chances of winning disputes and recovering lost revenue. Proactive management of chargebacks through representment will help safeguard your business and its bottom line.