Chargeback Management Services - Dispute Response Aug/ 30/ 2025 | 0

In 2025, mobile commerce is booming—but so are in-app chargebacks. Whether you’re selling digital goods, game upgrades, or subscriptions, chargeback fraud and accidental purchases can eat into your profits. Fortunately, proactive prevention can help you win the battle before a dispute even begins.

What Are In-App Purchase Chargebacks?

In-app purchase chargebacks occur when a customer disputes a mobile app transaction—often claiming they never made the purchase, didn’t authorize it, or didn’t receive the product. These disputes are commonly filed through credit card issuers or mobile platforms like Apple or Google.

Common Causes of In-App Chargebacks:

- Accidental purchases by children

- Misunderstanding recurring billing/subscriptions

- Fraudulent claims by users (friendly fraud)

- Delayed delivery or technical issues

- Lack of refund options or poor support

Why U.S. Businesses Must Act in 2025

Mobile apps are now a core revenue stream for U.S. businesses, from gaming startups to fitness platforms. But with stricter chargeback thresholds and higher processing fees, every dispute hurts more than ever.

Consequences of Frequent In-App Chargebacks:

- Account holds or termination by payment processors

- Revenue loss from product reversals

- Increased risk classification for your merchant account

- Time and resources spent on fighting disputes

Smart Prevention Strategies for In-App Purchases

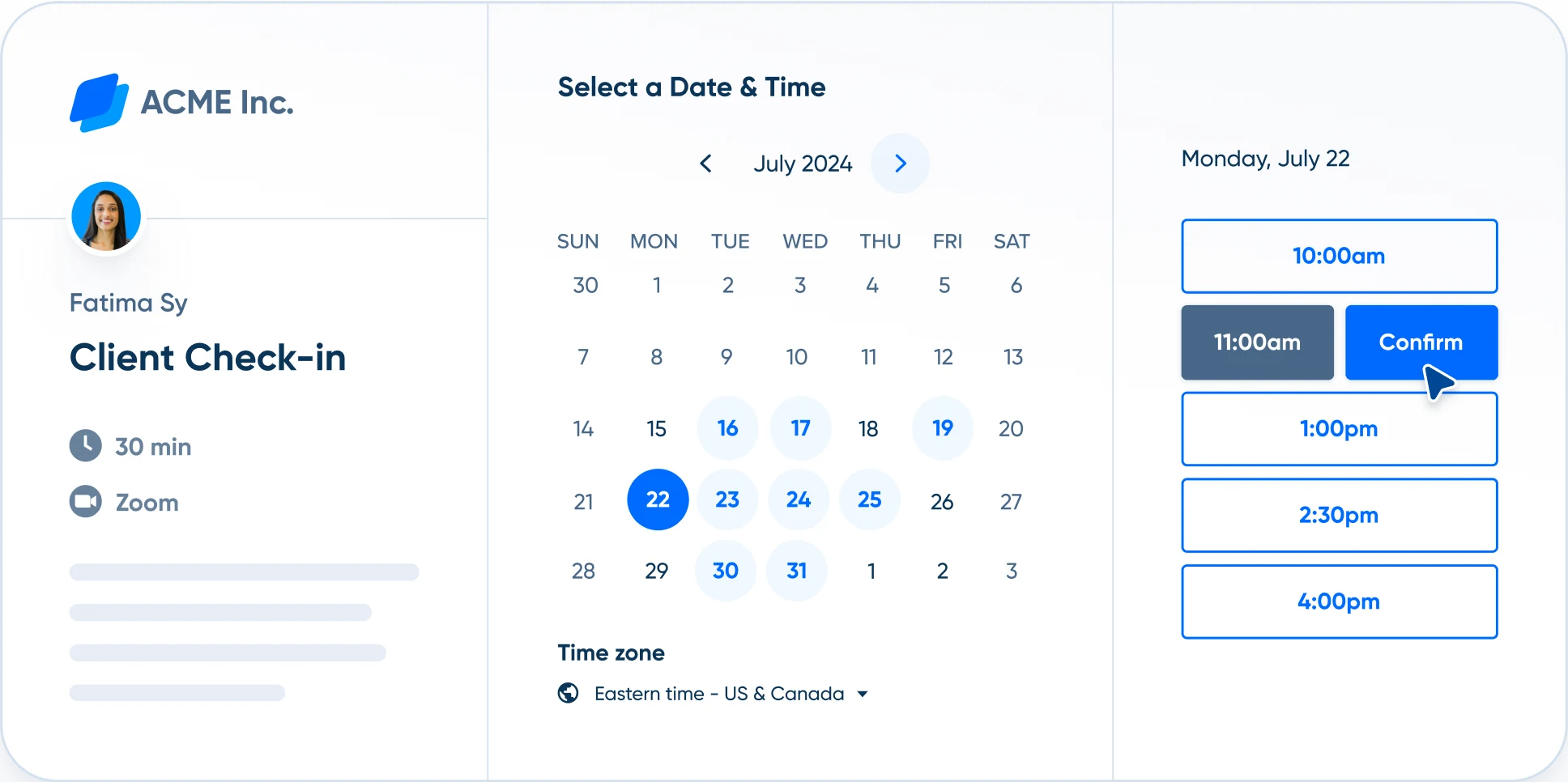

1. Use Clear Purchase Confirmations

Require extra confirmation steps before finalizing purchases—especially for minors or high-ticket items.

2. Implement Parental Controls

Offer settings that restrict purchases or require additional authentication to prevent accidental buys.

3. Display Transparent Pricing and Billing

Make your billing model crystal clear—especially for subscriptions, auto-renewals, and freemium upgrades.

4. Offer Easy Refunds and Support

Resolve customer issues before they escalate to chargebacks. Provide instant refund options and accessible support channels.

5. Enable Real-Time Alerts

Integrate fraud detection and real-time chargeback alerts to quickly respond to disputes and stop revenue leakage.

Fighting Back Against Friendly Fraud

In 2025, friendly fraud—when users knowingly file false disputes—is on the rise. Combat it with:

- Digital receipts and email confirmations

- IP and device tracking

- Detailed logs of in-app user behavior

- Screenshots of purchase confirmation flows

These details are vital when submitting evidence for chargeback representment.

Choose the Right Chargeback Partner

Working with a chargeback management firm like Dispute Response gives your business the edge in identifying fraud patterns, automating dispute responses, and reducing your chargeback ratio.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Final Thoughts: Prevention Pays Off

With a growing mobile user base and rising fraud risk, in-app chargeback prevention is no longer optional—it’s essential. The right mix of UX design, fraud controls, and proactive support can reduce disputes and boost your bottom line.

💡 Need Help Stopping In-App Chargebacks?

Dispute Response offers expert solutions tailored for mobile apps and digital businesses. Let’s protect your revenue—before the damage is done.