Chargeback Management Services - Dispute Response Jul/ 25/ 2025 | 0

Introduction to Apple Pay Disputes

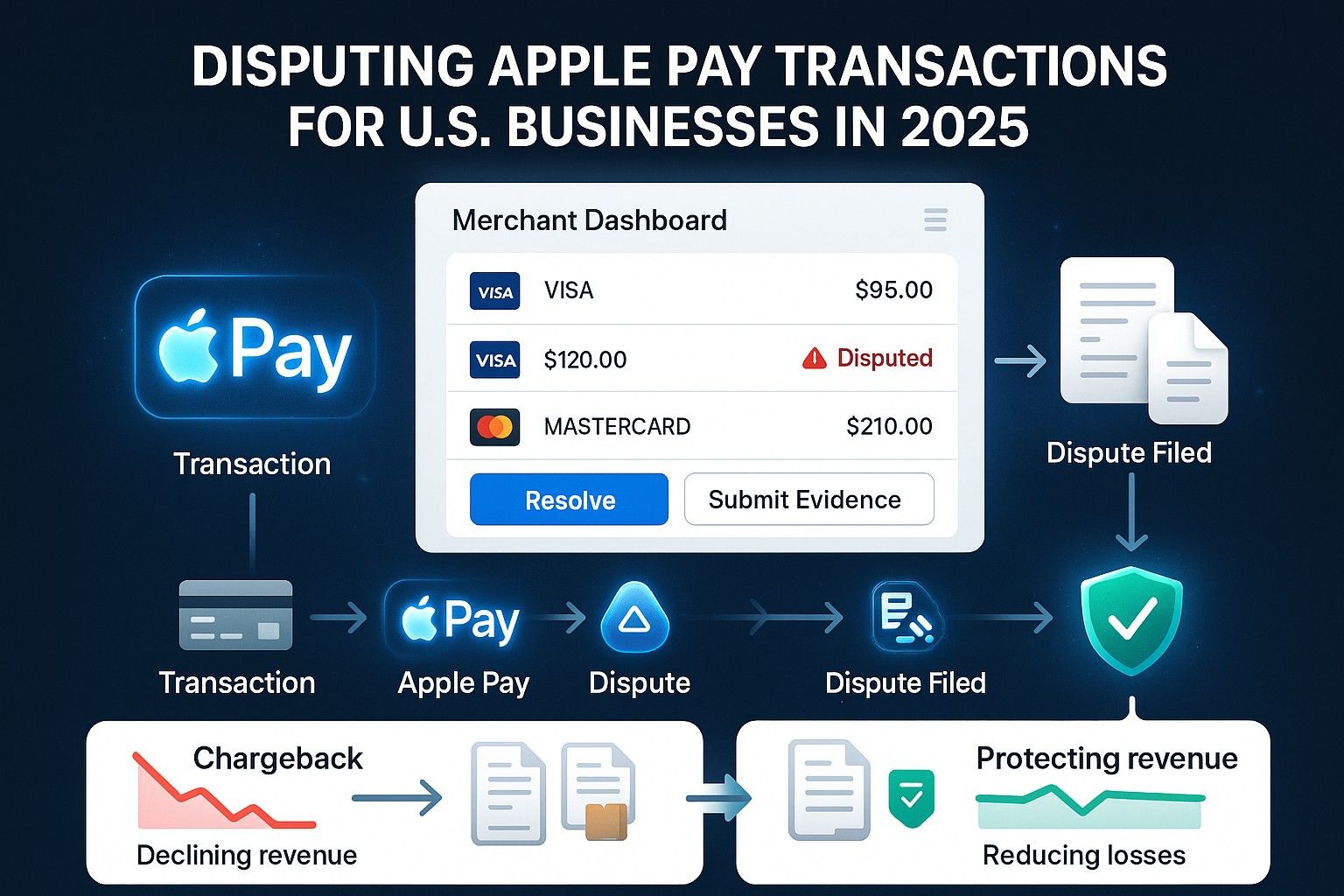

Apple Pay is a widely-used mobile payment solution, and while it offers convenience to consumers, it can sometimes lead to disputes and chargebacks for businesses. As a merchant, understanding how to handle these disputes is essential for minimizing revenue loss and maintaining good standing with payment networks.

How Apple Pay Disputes Happen

Apple Pay transactions are generally secure, but they are not immune to chargebacks. A chargeback occurs when a customer disputes a transaction through their bank or credit card provider. The dispute process for Apple Pay transactions is similar to those for other card payments, but understanding the nuances can help businesses handle them more effectively.

Common Reasons for Apple Pay Chargebacks

- Unauthorized Transactions

Customers may claim that they did not authorize the payment, either due to fraudulent activity or errors on their end. - Product Not Received

Customers might dispute a transaction if they feel the product was not delivered as expected or the service was not provided. - Quality Issues

If the product or service does not meet the customer’s expectations, they may initiate a chargeback. - Fraudulent Charges

Despite Apple Pay’s security features, stolen card information can still lead to fraudulent purchases that result in chargebacks.

How to Handle Apple Pay Disputes in 2025

- Understand the Chargeback Process

It’s essential to have a clear understanding of how chargebacks work in the context of Apple Pay. Be aware of deadlines and documentation requirements for disputing chargebacks effectively. - Gather Evidence

If a dispute arises, ensure you gather all relevant transaction details, including communication with the customer, shipping information, and proof of delivery. - Respond Promptly

Timely responses to chargeback requests are crucial. Missing deadlines can result in losing the dispute automatically.

Best Practices to Prevent Apple Pay Chargebacks

- Use Advanced Fraud Detection

Leverage tools that can detect potentially fraudulent transactions before they are completed. - Clear Communication

Ensure your business’s terms and conditions are clear, including refund and return policies. - Provide Excellent Customer Support

Often, chargebacks arise from a lack of communication or dissatisfaction. Offering outstanding customer service can reduce disputes. - Monitor Transactions

Keep an eye on high-risk transactions and look for patterns that could indicate fraudulent activity.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

The Bottom Line on Apple Pay Disputes

Disputes involving Apple Pay transactions can be complex, but with the right knowledge and preventive measures, U.S. businesses can protect themselves from unnecessary financial losses. Staying informed about the latest chargeback processes and using best practices for prevention are crucial for minimizing risk.