Chargeback Management Services - Dispute Response Jul/ 7/ 2025 | 0

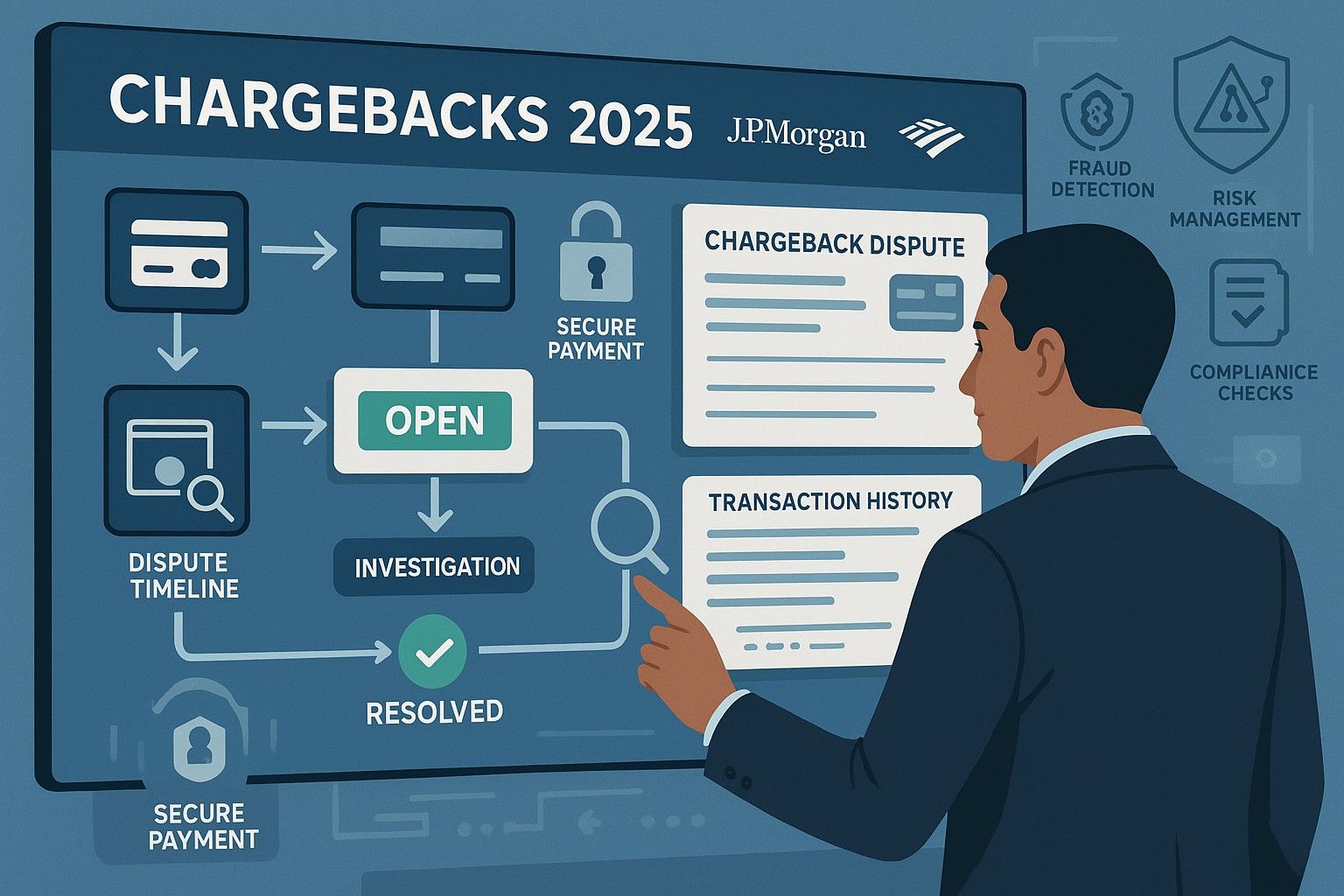

In 2025, U.S. financial institutions continue to play a pivotal role in chargeback management—often acting as both the first line of defense and the final decision-makers in disputes. As the chargeback landscape becomes more complex, businesses must understand how banks operate within this system to proactively reduce fraud and retain revenue.

The Role of Issuing Banks in Chargebacks

When a consumer disputes a charge, their bank (known as the issuing bank) initiates the chargeback process. In many cases, these banks err on the side of the consumer—especially in the absence of compelling evidence from the merchant. Understanding how these institutions assess claims is critical for any U.S. business aiming to protect itself.

Why Issuers Favor Consumers

Issuing banks are legally obligated to safeguard consumer rights under regulations like the Fair Credit Billing Act and Regulation Z. This legal responsibility often leads to an initial bias in the consumer’s favor, which can cause significant losses for merchants who are unprepared.

In 2025, advancements in AI fraud detection and automated dispute systems have made the process faster—but not necessarily more favorable for merchants. That’s why proper documentation, real-time alerts, and evidence submission protocols are essential.

Acquiring Banks: The Merchant’s Ally

Acquiring banks (merchant banks) are the intermediaries between businesses and card networks like Visa and Mastercard. While their goal is to help merchants stay compliant and profitable, they also must adhere to strict chargeback thresholds and timelines set by the card brands.

Acquirers now offer chargeback monitoring tools and dispute dashboards that can help merchants stay ahead of incoming claims. These insights are essential for understanding high-risk trends, particularly for U.S. businesses in industries like travel, digital goods, or subscription services.

Key Trends in 2025: Technology, Data, and Collaboration

Today’s leading banks are using machine learning models to detect suspicious behavior and block illegitimate disputes before they reach the merchant. Simultaneously, collaboration between cardholders, issuers, and merchants has improved through solutions like Ethoca Alerts and Verifi’s Rapid Dispute Resolution (RDR).

Businesses that integrate these tools with their CRMs and transaction logs can preempt chargebacks before they escalate into costly disputes. Dispute Response helps merchants implement these solutions and provides expert support throughout the entire chargeback process.

What Merchants Can Do Right Now

To stay protected in 2025 and beyond, U.S. merchants should:

- Integrate real-time chargeback alerts into their payment system

- Use clear billing descriptors to avoid confusion at the cardholder level

- Maintain thorough transaction records including proof of delivery and customer communication

- Train staff on chargeback rules and evidence gathering

- Partner with a chargeback management expert like Dispute Response for tailored protection

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

Final Thoughts

Understanding how financial institutions manage chargebacks gives merchants a strategic advantage. With the right tools and expert support, you can reduce disputes, recover lost revenue, and stay compliant with evolving bank and card brand standards.

Dispute Response is committed to helping U.S. businesses navigate this ever-changing landscape with confidence and control.