Chargeback Management Services - Dispute Response Jul/ 26/ 2025 | 0

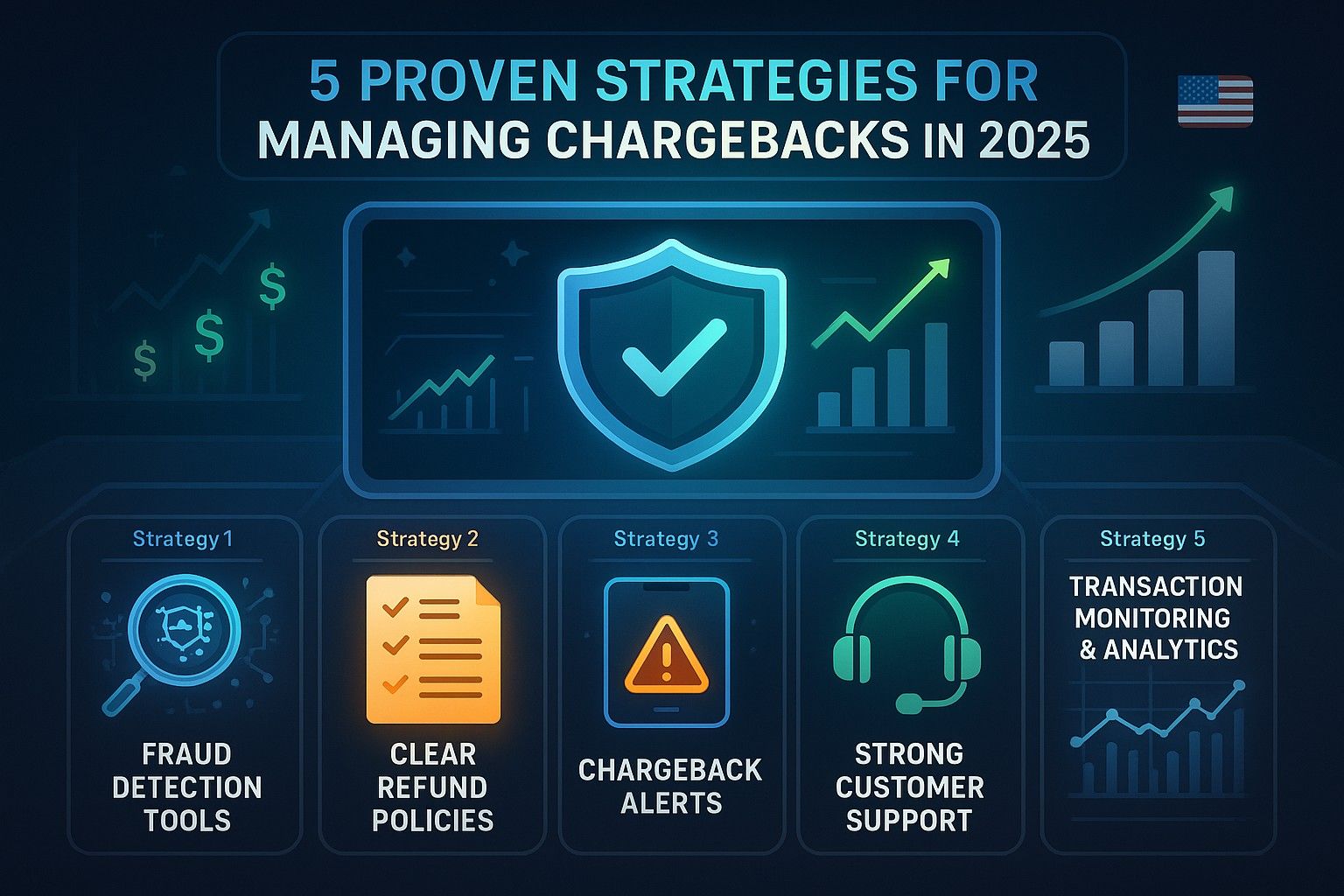

Chargebacks are a significant concern for U.S. businesses, especially in the realm of e-commerce. They can lead to financial losses, disrupted cash flow, and even account termination by payment processors. With the ever-evolving landscape of digital payments, it’s crucial for businesses to adopt proactive strategies to manage and reduce chargebacks effectively. In this post, we’ll outline five proven strategies that can help businesses reduce chargebacks in 2025.

1. Implement Robust Fraud Prevention Measures

Fraud is a primary cause of chargebacks. By investing in advanced fraud detection tools, businesses can prevent fraudulent transactions before they occur. Tools like machine learning-based fraud detection systems, real-time transaction monitoring, and 3D Secure 2.0 can help identify suspicious activity and block fraudulent charges.

Key Fraud Prevention Tactics:

- Use Address Verification Service (AVS) to check the billing address.

- Implement Multi-Factor Authentication (MFA) for high-risk transactions.

- Invest in fraud detection tools that use AI to detect anomalies.

2. Enhance Customer Service and Communication

One of the leading reasons for chargebacks is customer dissatisfaction. Offering superior customer service can often prevent chargebacks from happening. By proactively communicating with customers and resolving issues quickly, businesses can reduce disputes that lead to chargebacks.

Customer Service Best Practices:

- Provide easy-to-find contact information on your website.

- Offer 24/7 support through multiple channels (phone, email, live chat).

- Resolve customer complaints promptly to prevent disputes from escalating.

Email us anytime!

Email customer service 24/7

Call us anytime!

Reach customer care 24/7 at +1 (888) 927-5152

3. Provide Clear Billing Descriptions

Ambiguous or unclear billing descriptions are a common cause of chargebacks. Customers may not recognize a charge and may assume it’s fraudulent, leading them to initiate a chargeback. Ensure that your billing descriptions are clear, accurate, and easily recognizable.

Tips for Clear Billing Descriptions:

- Use your business name and a short description of the product or service.

- Include your contact information in the billing descriptor.

- Keep descriptions consistent to avoid confusion.

4. Use a Chargeback Management System

A chargeback management system (CBMS) helps businesses monitor and respond to chargebacks efficiently. By automating the chargeback process, businesses can quickly assess the validity of a chargeback and respond in a timely manner.

Benefits of a Chargeback Management System:

- Automates dispute management and evidence collection.

- Provides real-time notifications on chargebacks.

- Helps reduce manual errors and speed up the response process.

5. Review and Update Your Refund Policy

A clear, concise, and easily accessible refund policy can help prevent chargebacks. By setting clear expectations for your customers, you can reduce misunderstandings and increase satisfaction. Ensure your refund policy is visible at the point of sale and in follow-up communications.

Best Practices for Refund Policies:

- Be transparent about refund timelines and processes.

- Offer a hassle-free return process for unsatisfied customers.

- Clearly explain the steps for initiating a refund or dispute.

By incorporating these strategies into your business processes, you can effectively reduce the occurrence of chargebacks and their impact on your bottom line. Stay ahead of the competition and safeguard your revenue by making chargeback prevention a priority in 2025.